Pluxee Annual Report 2025

-

Cover

This copy of the annual financial reporting of Pluxee N.V. for the year ended August 31, 2025 is not presented in the ESEF-format as specified in the Regulatory Technical Standards on ESEF (Delegated Regulation (EU) 2019/815). The ESEF single reporting package is available at: www.afm.nl/en/sector/registers.

-

Introduction

Fiscal 2025 was another milestone year for Pluxee, marked by strong execution, profitable growth, and continued progress in delivering on our strategic vision.

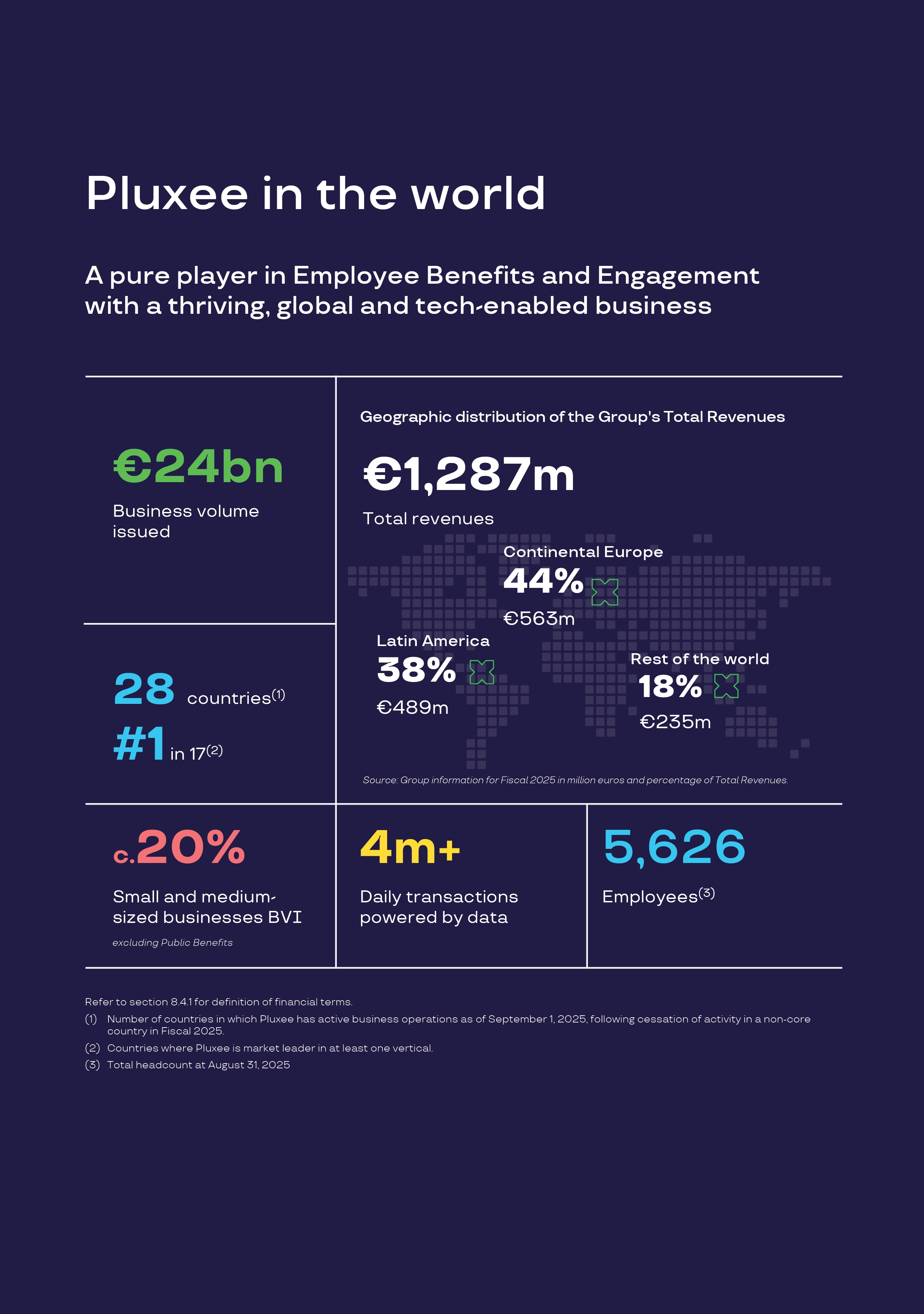

Pluxee continues to execute its growth ambition in a world moving at great speed, capturing opportunities in our high potential Employee Benefit and Engagement market. Robust, sustained demand for the Group’s solutions in Fiscal 2025 underlined the strength and resilience of our business model, amid a challenging political and economic environment. In Fiscal 2025, Pluxee further strengthened its global leadership position, supported by its continuously enhanced digital multi-benefit offering. The Group is also particularly proud to have expanded its global presence through strategic acquisitions across its three regions, including Europe, Latin America, and Asia.

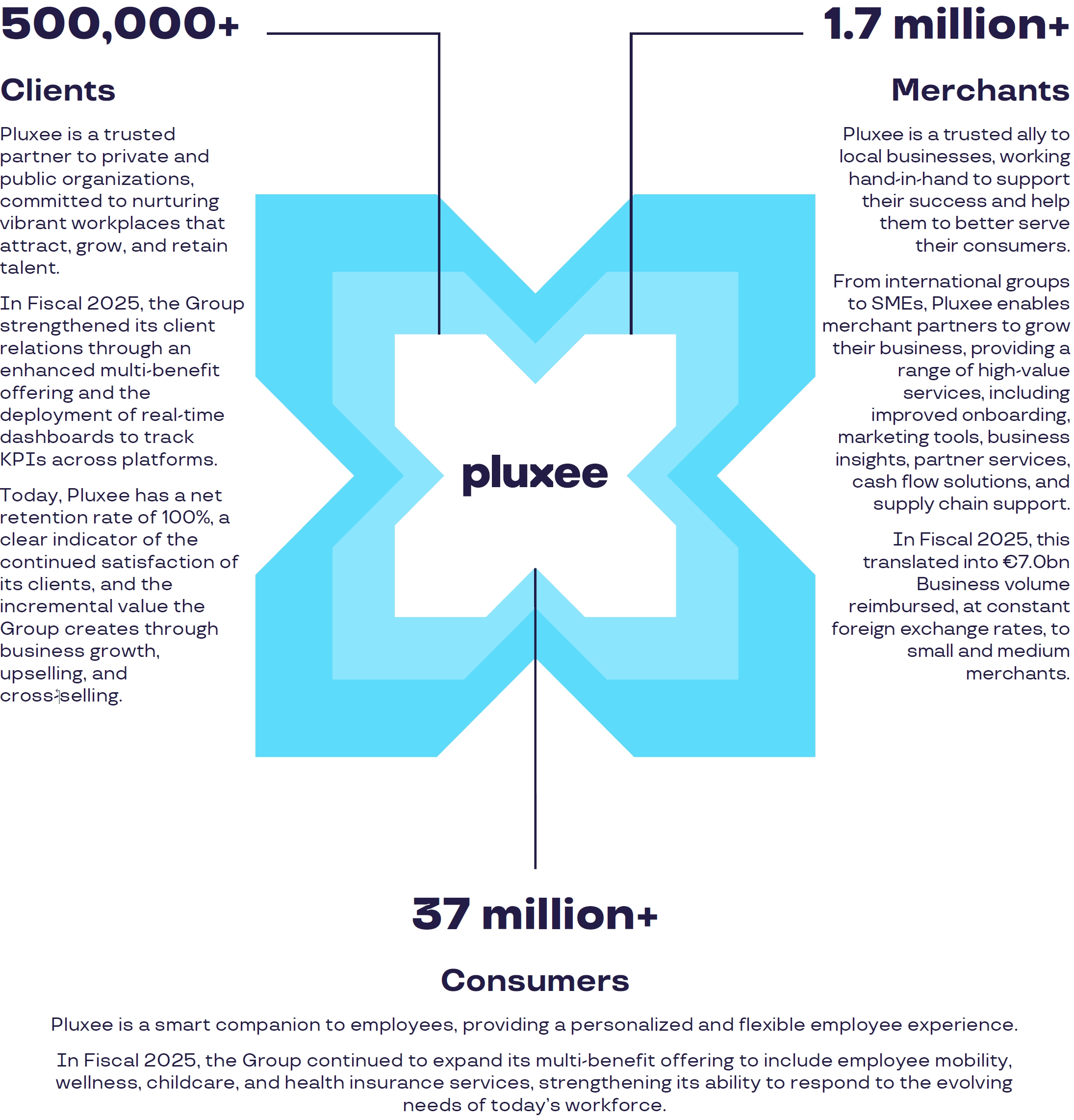

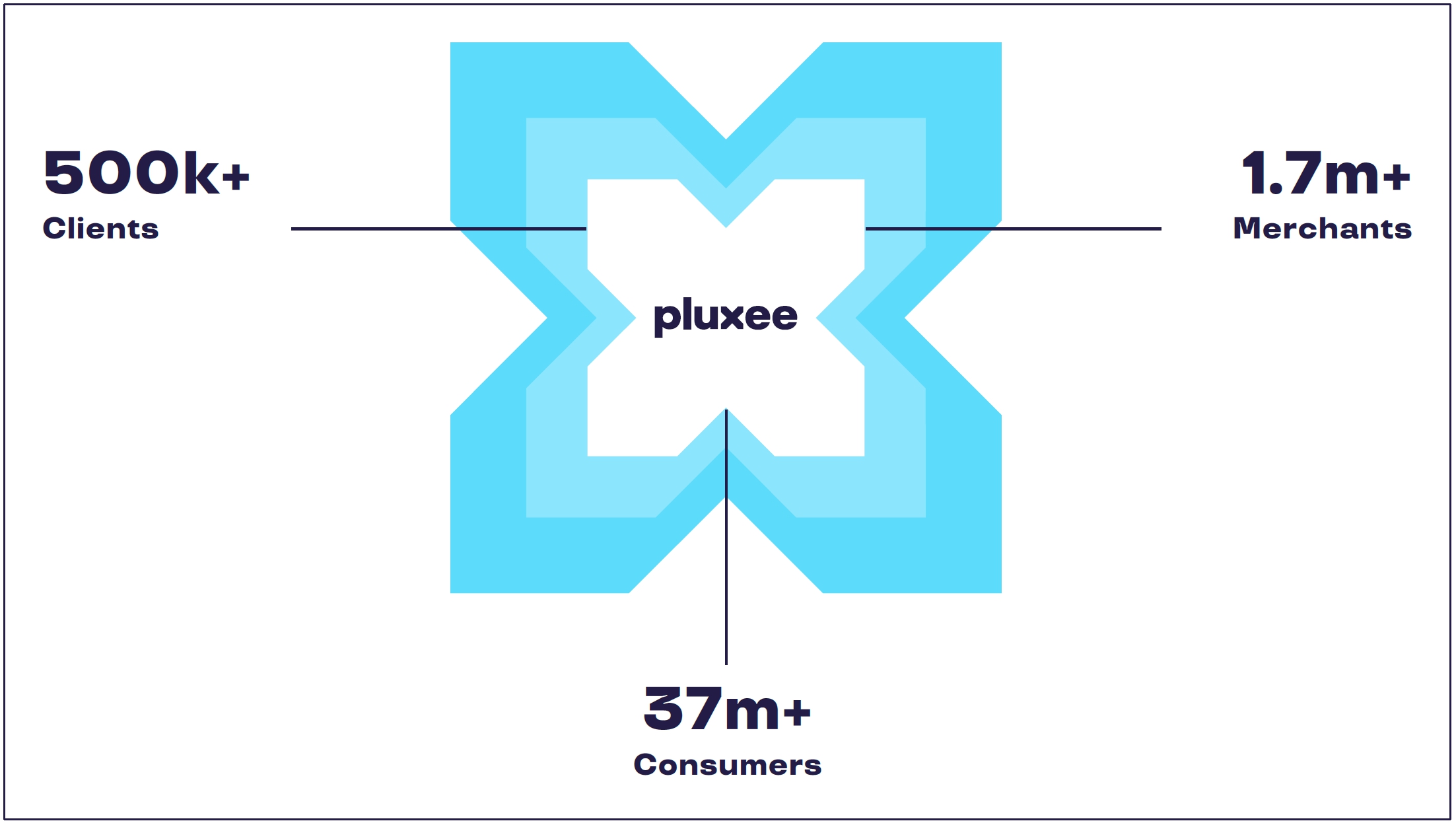

The outlook for the Employee Benefit and Engagement sector remains promising, as companies recognize the importance of fostering employee engagement to sustain their competitive advantage. At the center of a virtuous B2B2C ecosystem, Pluxee continues to demonstrate the strength of its strategy, today serving over 500,000 corporate clients and their more than 37 million employees, while connecting them with over 1.7 million merchant partners. The Board of Directors is proud to support a Group that creates such a positive impact for businesses, public institutions, and beneficiaries worldwide.

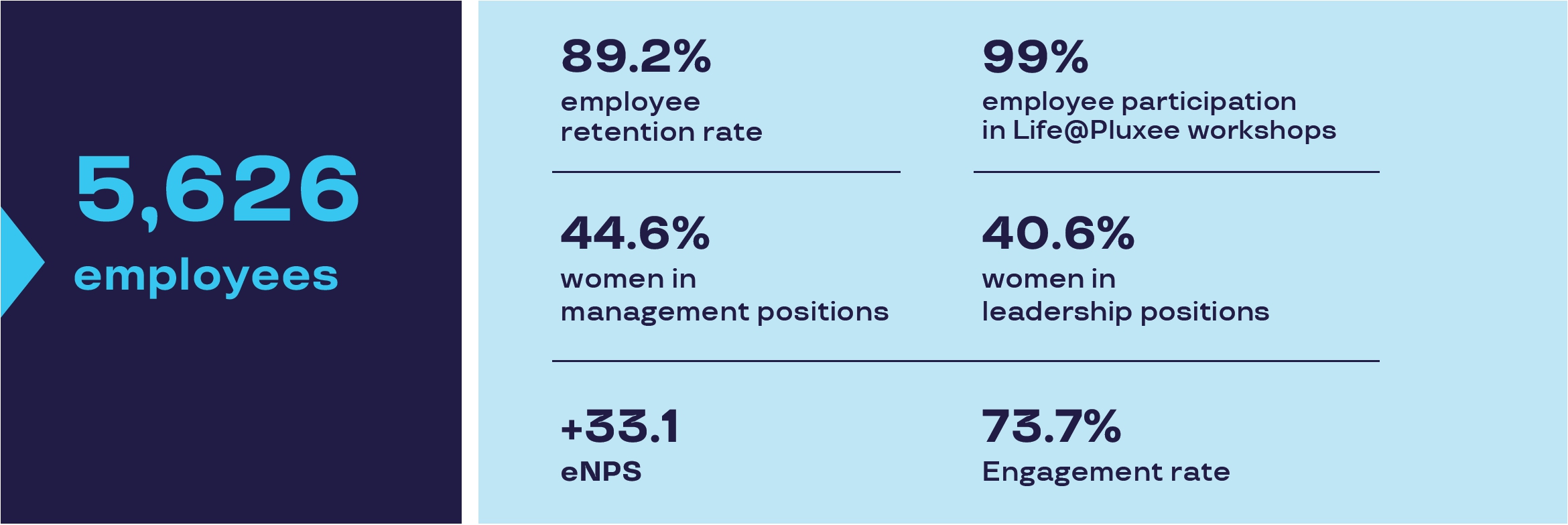

Following last year’s successful spin-off, Pluxee has firmly established itself as a full-fledged, autonomous player, with a strong identity and clear strategic roadmap. The achievements of Fiscal 2025 are first and foremost a testament to our 5,626 employees, whose energy and commitment have been key to developing the business and attaining such impressive results.

“Pluxee has firmly established itself as a full-fledged, autonomous player, with a strong identity and clear strategic roadmap.”

As we enter the new fiscal year, Pluxee is embarking on an exciting new chapter. We will continue to enhance what is already the market’s most comprehensive offering, consolidating our position as the leading pure player in the Employee Benefit and Engagement sector.

The employee engagement sector has continued to grow over the last fiscal year. What is driving this momentum?

In today’s fast-changing world, where companies are facing rising pressure to deliver stronger performance, employee engagement has become an imperative for any successful business.

To better understand what drives engagement, we recently conducted a global study. The results were striking: while 83% of employees say they “like” or even “love” their company, lasting engagement depends on clear signs of care and recognition. Employees are looking for companies that help them to balance their personal and professional priorities, at all stages of life.

Another significant insight is that employee benefits are the second biggest factor of a company’s appeal, just after attractive salaries, underlining the continued relevance of Pluxee’s mission: to create a personalized and sustainable employee experience, at work and beyond.

Fiscal 2025 was a pivotal year for Pluxee. We stepped up the execution of our strategy to strengthen our leadership by reinforcing our activities in Meal & Food benefits, while expanding our global Employee Benefit and Engagement offerings.

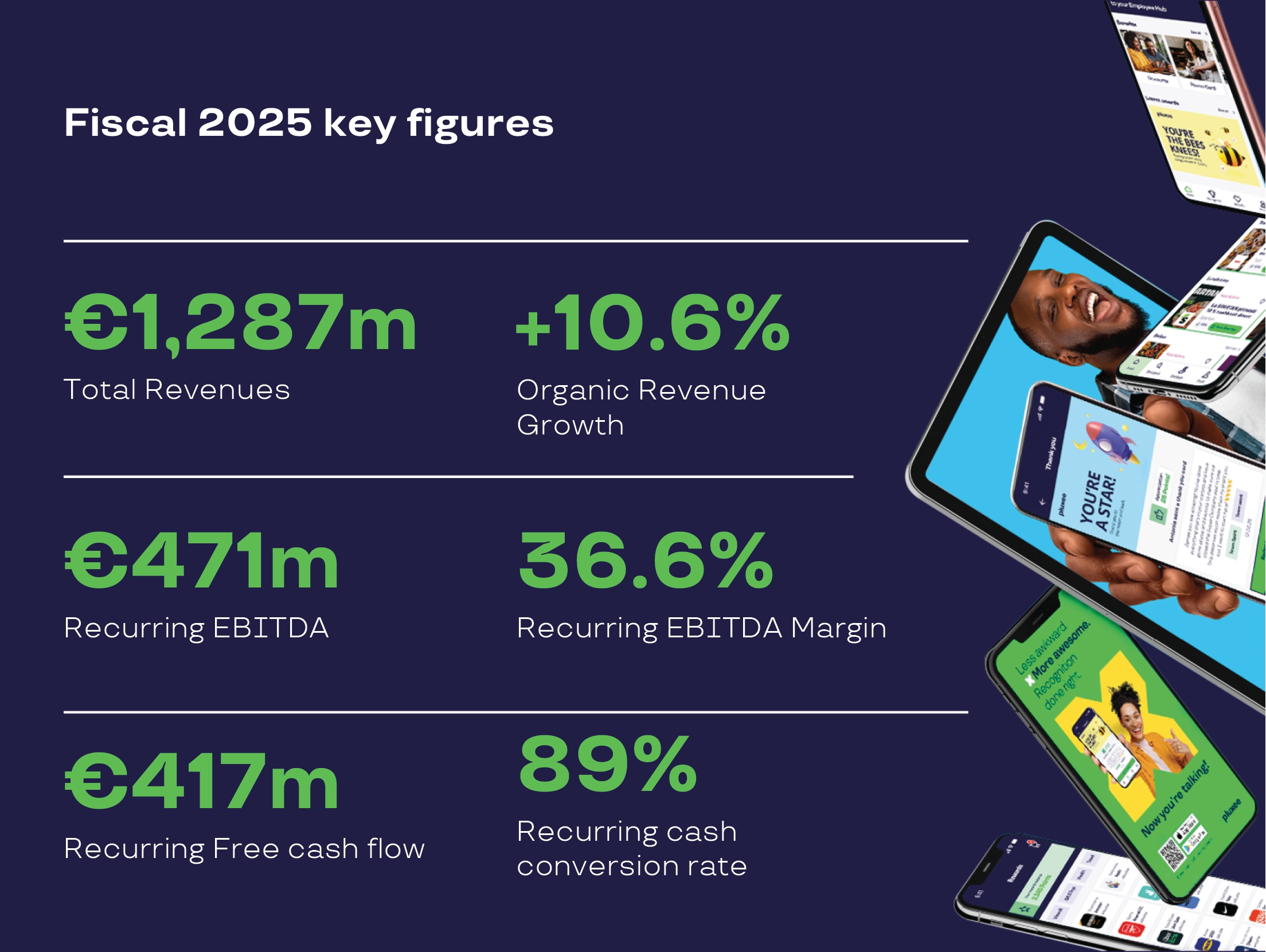

Of course, what stands out for this fiscal year is that we achieved all our financial targets, delivering +10.6% Total revenue organic growth, in line with our low double-digit objective, +230 basis point Recurring EBITDA margin on an organic basis and 89% Recurring cash conversion.

This year’s strong performance provided a powerful demonstration of our strategy execution, with business volume issued (BVI) totaling 24 billion euros. I am very proud of these results, achieved thanks to the steadfast commitment of our teams around the world.

Over the past year, Pluxee has brought new expertise and talent on board through strategic acquisitions. How has M&A supported your growth ambitions?

M&A played a decisive role strengthening our presence in key markets, broadening our offering, and integrating innovative technologies.

It was a busy year including the integration of Cobee and its roll-out in Spain, Mexico and Portugal, together with the acquisitions of Benefício Fácil, a provider of mobility solutions for public transport in Brazil, and MyBenefits, a Romanian company that has developed innovative technology to offer flexible benefits. We are equally excited to bring on board two local employee benefit players, Welfare Solutions in Italy and Benefity in the Czech Republic, as well as Skipr, a state-of-the-art employee mobility solution in Belgium, and ProEves, a leading corporate childcare player in India.

At the same time, our partnership with Santander is now bearing fruit. The venture is fully operational, with Santander’s nearly 4,500 sales force managers — of whom around 2,500 focus on SMEs — working to significantly strengthen our commercial presence and growth potential in Brazil.

We are the only pure player in Employee Benefits and Engagement, serving more than 37 million consumers. Behind Pluxee’s large end-user base are hundreds of thousands of merchant relationships and millions of daily transactions, giving us unique insights to better serve our clients and meet employees’ needs. Drawing on these extensive data assets, we are able to deliver the most comprehensive range of solutions in the market, with over 250 products.

Employees increasingly seek personalized and flexible benefits: they want to choose what works for them. I’m excited about how our product range is evolving to meet these expectations. For instance with the acquisition of Skipr, we are accelerating our mobility offering, powered by cutting-edge SaaS technology. It enables employees to select their preferred mobility options each day, while giving human resources teams a flexible tool to personalize benefits, manage expenses efficiently, and track carbon footprints.

We invest a substantial share of our Total Revenues each year. Around 90% of these investments are directed to information technology, data and digital infrastructure, representing around 100 million euros annually.

Through these investments, we have built a cutting-edge modular one-platform ecosystem that processes more than four million transactions daily. It allows us to structure and automate data at scale so that we can analyze behavior in real time, deepen our consumer knowledge, and monetize our findings, creating real value for Pluxee and our stakeholders. For example, in Romania, we leveraged our data assets to create premium solutions for merchants, providing actionable insights to optimize their performance. Adoption accelerated rapidly: within months, over 40% of merchants used one of these solutions, showing clear market demand.

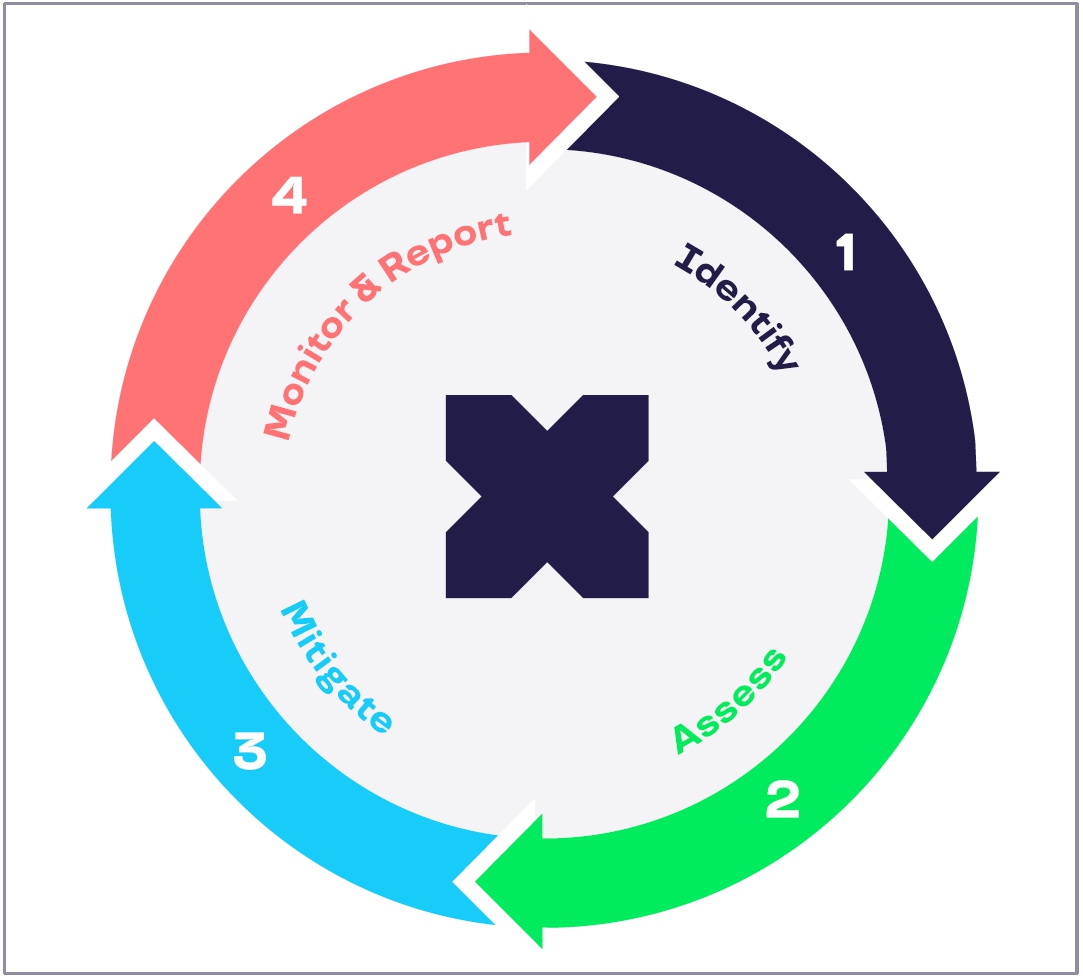

Increased digitalization also means we are paying constant attention to cybersecurity, which is why we continue to invest in recruiting leading experts to strengthen our capabilities.

Finally, artificial intelligence is also a key focus. We empower our teams to use AI effectively and explore how it can enhance the experience of all our stakeholders, starting with client services. In France, we use AI chatbots to filter requests and guide consumers to human support at the optimal moment in their journey.

“Behind Pluxee’s large end-user base are hundreds of thousands of merchant relationships and millions of transactions, giving us unique insights to better serve our clients and meet employees’ needs.”

In a fast-changing world, how does the Group address regulatory changes across the countries where it is present?

Regulatory evolution is inherent to the employee benefit business, in every country where we operate. Continuously modernizing local frameworks is vital to meet evolving consumer needs and consumption patterns.

That is why Pluxee actively engages in constructive dialogue with public authorities to ensure regulatory changes reflect the needs of all stakeholders — employers, the end-user employees, and our merchant partners. By continuously adapting to market and regulatory developments, the Group contributes to the long-term sustainability and broader deployment of the employee benefit ecosystem.

The more than 1.7 million merchants in our network are key partners. We continuously support their businesses by generating incremental volumes, streamlining operations, and providing complementary services. All of this helps them to drive growth, optimize costs, and build loyalty.

As an example,, our data and analytics expertise enables merchants in Colombia and Mexico to deploy marketing campaigns, dynamically segmented for their user base, with measurable return on investment. In France, we integrated geolocation into our apps to spotlight affiliated merchants that embrace sustainable sourcing practices.

The value we bring is clear: 7.0 billion euro business volume, at constant foreign exchange rates, were reimbursed to small and medium merchants in Fiscal 2025, with the ambition to grow this number to 8 billion euros by the end of Fiscal 2026.

Employee engagement is at the core of Pluxee’s business. How are you engaging your own teams to deliver on these ambitions?

Our mission is simple yet powerful: to create a personalized and sustainable employee experience, both at work and beyond. This shared mission fuels our growth, individually and as one team.

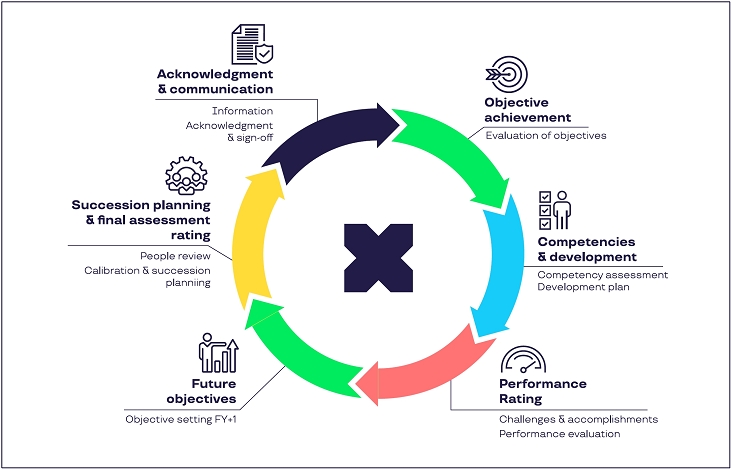

We began by focusing on how we work together. At the heart of our business is Life@Pluxee, our cultural framework defined in Fiscal 2024, which outlines how we collaborate to be a smart leader in Employee Benefits and Engagement. Complementing this is our Leadership Compass, which ensures managers consistently bring our values to life across the organization.

This year, we reviewed our Employee Value Proposition, the experience we promise to current and future employees. Built around four key pillars - Inspire, Impact, Grow and Belong - it serves as a strategic lever to attract and retain a high-performing, diverse workforce.

When it comes to benefits, we lead by example. All 5,626 employees enjoy meaningful, universal benefits including a minimum of 12 weeks of parental leave, psychological support, a family-care leave option to assist loved ones, and financial protection. These benefits have been instrumental in enhancing engagement, with our employee Net Promoter Score rising to +33.1 this year.

Sustainability is a strategic priority for Pluxee. How is it shaping Pluxee’s future, and is there a project you are particularly proud of?

Developing our growth ambition sustainably is at the center of our business model, shaping everything we do: from building trust with our stakeholders and promoting employee well-being, to supporting local communities and reducing our environmental impact to achieve carbon neutrality by 2035.

In Fiscal 2025, we strengthened these commitments, making demonstrable headway in our objective of expanding the reach of our offering to small and medium-sized merchants through a suite of services tailored to them. It is gratifying to know that we contribute to the growth of their businesses while empowering them with digital capabilities through accessible, business-enhancing tools.

We also supported our local communities in expanding financial inclusion for underprivileged populations. For instance, in the Czech Republic, we launched a scholarship program in partnership with Stop Hunger and Czechitas to support the professional integration of women in vulnerable situations. By providing comprehensive and personalized support in training, mentoring, and job search activities, we helped several participants secure stable employment in the tech sector this year — a success that makes both me and our employees particularly proud.

All these accomplishments reflect the dedication of our global and local teams, the strategic leadership of our Executive Committee, the ongoing support of our Board, and the confidence placed in us by clients, consumers, and merchant partners.

In an increasingly challenging and uncertain environment, Pluxee has been able to deliver robust commercial performance, driven by strong new-client momentum and healthy net retention. These positive business trends give us confidence in our ability to leverage Pluxee’s resilient business model, activate our growth drivers, and pursue greater operational efficiencies to navigate the current context while sustaining profitable growth over the long run.

As the beating heart of a rich and expanding B2B2C ecosystem of clients, merchants, and consumers, Pluxee continues to drive the expansion of the Employee Benefit and Engagement market.

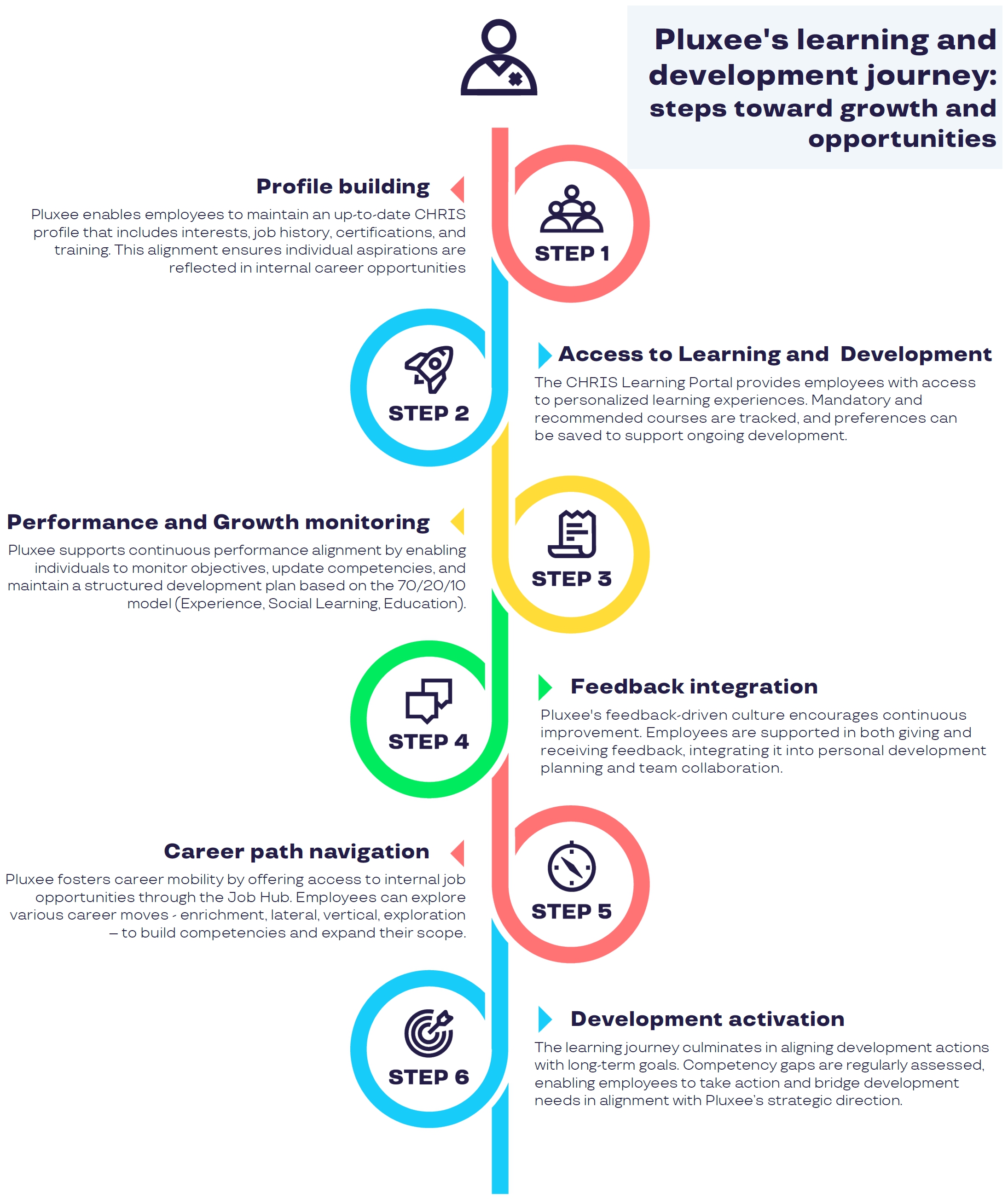

People are the cornerstone of Pluxee’s success. The company is dedicated to cultivating an engaging employee experience that gathers teams around a shared culture and fuels its ambition to be a smart leader in Employee Benefits and Engagement.

Life@Pluxee, the Group’s corporate culture framework, defines how Pluxee engages with all its stakeholders, striving to be a Smart Leader of Employee Benefits and Engagement.

In Fiscal 2025, it was broadly deployed across Pluxee, with 99% of employees participating in dedicated workshops.

During the year, Pluxee took the model one step further by creating the Life@Pluxee Leadership Compass. This tool outlines eight leadership competencies that will foster Pluxee’s culture and business.

In 2025, Pluxee strengthened its commitment to its employees with an enriched employee value proposition. This promise stems from one ambition: to be a smart leader of Employee Benefits and Engagement. It is supported by four key pillars:

► Belong ► Inspire ► Impact ► Grow Pluxee is the beating heart of its communities. Employees are part of something bigger, an inclusive and connected community where everyone has a place, and every contribution counts. Each and every Pluxee employee is moving the world of work forward. This pillar reflects the creative, collaborative energy that turns bold ideas into possibilities and sparks new ways of working. By leveraging four decades of market insight in combination with data and technology, employees build richer, more engaging digital experiences. Pluxee employees are passionate about the employee experience and improving everyday life for millions. They enable moments that matter, helping to bring positive change across Pluxee’s ecosystem of clients, consumers, merchants, and communities. This Impact is reflected in Pluxee’s bold commitment to diversity, inclusion, sustainability, and its support for local economies around the world. At Pluxee, everyone is accountable for delivering global performance – collaborating as One Team, developing skills collectively, and shaping a brighter future. In Fiscal 2025, Pluxee was awarded the Great Place to Work certification in multiple locations around the world, demonstrating the Group’s success in creating an environment where employees thrive.

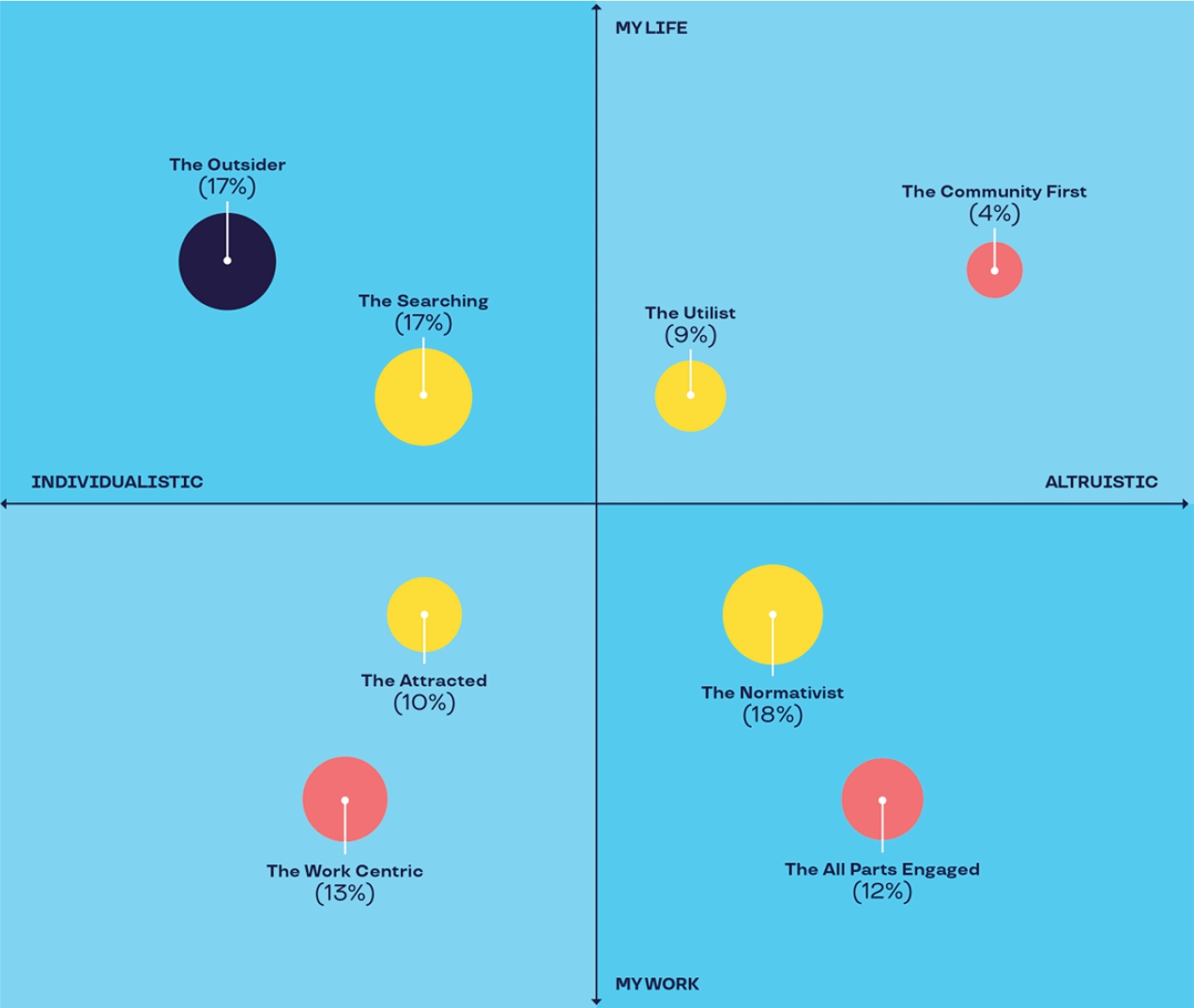

In 2025, Pluxee conducted a study with Ipsos to obtain a broad and precise view of how employees experience engagement around the world. The research covers ten countries and includes the responses of 8,700 people across diverse sectors and life stages, 80 video testimonials, and contributions from top-tier experts. Combining both breadth and depth, the study leverages comprehensive international data and representative samples to arrive at valuable insights into how people manage work today within the broader context of their lives.

“Employees cannot divide their lives into two separate parts. They seek to blend various aspects of their lives into a unified whole. The true challenge is not balancing work and life, but rather finding synergies between both.”

Employees view their work as a meaningful part of their lives, alongside personal and community commitments. However, they do not want to feel pressured to choose between work and their personal priorities. A vast majority of respondents (71%) say work is essential but not the sole focus of their lives.

Engagement at work is not something employees unquestioningly adopt and it is not as simple as being all in or all out. Rather, it is a living, breathing spectrum that people navigate, from doing the bare minimum to achieving peak performance. Measured Engagement is a consistent phenomenon observed across all generations of employees, accounting for 32 to 35% of the workforce. These employees choose to engage with their work intentionally, without compromising their boundaries, personal values, or the balance they seek to strike between work, personal life, and community commitments.

► 83%

of employees used words such as ‘like’ or ‘love’ to describe how they feel about their organization

► 71%

say work is essential but not the sole focus of their lives

► 34%

of employees identify with Measured Engagement

“Workers often feel more in control of their lives as they find their own ways to engage, which can lead to a satisfying sense of empowerment and increased agency.”

The study highlights two primary factors that influence engagement: the importance placed on life versus work, and whether people’s focus is more personal or collective. These elements combine to create eight distinct profiles, each reflecting a different shade of engagement people might experience throughout their careers. These profiles range from those who take a measured approach to engagement, such as The Seeker, who searches for a greater sense of purpose outside of the workplace, to highly engaged profiles like The Work Centric, who prioritizes work over personal life.

In the words of expert Jean-Baptiste Barfety, these eight shades of engagement paint a picture of employee engagement that fluctuates with people’s life stages and priorities: they commit to their work while setting boundaries, they commit to social causes when they can, and conversely, they recharge their batteries when they feel the need.

► 36%

rank ‘benefits that fit my needs’ as the top driver of company attractiveness

► 43%

say a caring atmosphere at work is the factor that makes them feel the most fulfilled in their job

Employees know exactly what they seek in return for their contributions. They are particularly drawn to companies that focus on material benefits, growth and autonomy, and that foster human connections. These three key employee expectations establish a strong foundation for companies seeking to build a mutually beneficial relationship with their employees. For engagement to truly benefit both parties, organizations need to take it to the next level by gaining a deeper, more up-close and personal view of who their employees are.

When asked about the main factors that make a company attractive, more than one-third of employees mentioned benefits that genuinely meet their needs. Meeting this growing demand for personalized benefits is the way companies can unleash the full potential of their employees.

Fiscal 2025 was a second key year in the Group’s strategic development, marked by strong execution and the delivery of all targeted financial and strategic objectives. Commercial performance remained robust, with Business volumes issued exceeding 24 billion euros and driving Total Revenues organic growth up +10.6%. Recurring EBITDA margin expanded by +230 basis points on an organic basis, while the Group sustained a strong Recurring Cash Conversion rate of 89% — both well above initial objectives.

Source: Group information as of Fiscal 2025. For more information, see section 3 Business performance; Financial indicator not defined in IFRS, see section 3.5 Alternative performance measure (APM) definitions

In Fiscal 2025, Pluxee continued to advance the execution of its M&A strategy, supporting strategic ambitions and delivering incremental contributions to revenue organic growth over the year.

The integration of Cobee - a native digital player in employee benefits and engagement represented a significant milestone for the Group, reinforcing Pluxee’s leading position across underpenetrated and growing employee benefit markets in Spain, Mexico and Portugal. Pluxee signed a strategic partnership with Santander — one of Brazil’s largest private banks — in Fiscal 2024, reinforcing its leading position in the Brazilian market. The exclusive distribution agreement is now fully operational and actively contributes to Pluxee’s commercial expansion and growth prospects in Brazil. Pluxee acquired 100% of Benefício Fácil, a leading provider of public transport mobility solutions in Brazil, a fast-growing market where employee mobility benefits are mandatory. This acquisition supports Pluxee’s presence in the mobility sector and strengthens its comprehensive employee benefit offer in a key market. Pluxee also completed several strategic acquisitions of companies that strengthen the Group’s presence and competitive position in key markets across Continental Europe, Latin America and Rest of the world. These acquisitions are accelerating the Group’s multi-benefit product innovation and enhancing its digital and technology capabilities.

Sustainability is more than a responsibility: it is a driving force behind the way Pluxee does business

As the beating heart of our communities, Pluxee ensures its business is grounded in integrity, reliability, and respect. Building on this trust, the Group empowers its teams by cultivating safe, inclusive workplaces that embrace diversity, equity, and inclusion. Through our products, we amplify the impact we have on our clients’ employees. Progress unfolds when people come together, which is why Pluxee drives virtuous growth by supporting local communities, promoting sustainable consumption and inclusion, and advancing environmental awareness.

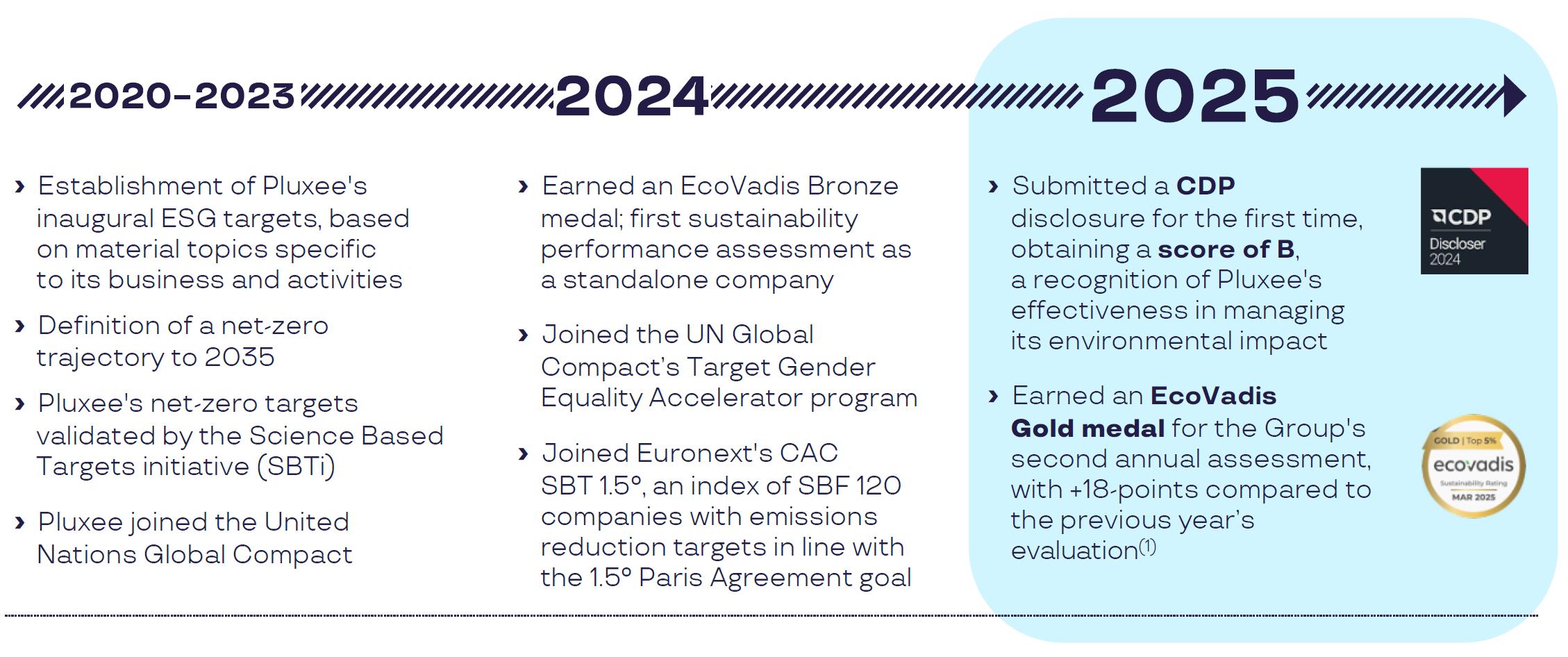

Since 2020, Pluxee has achieved major milestones on sustainability by setting inaugural ESG targets and an SBTi-validated net-zero trajectory toward 2035. The Group also joined the United Nations Global Compact and participated in its Target Gender Equality Accelerator program.

In Fiscal 2025, the Group completed its first Carbon Disclosure Project (CDP) submission — which received a B score — and earned an EcoVadis Gold medal for its second consecutive annual assessment, underscoring the accelerating maturity of Pluxee’s sustainability agenda.

Beyond Fiscal 2026, Pluxee will continue to move ahead to meet its ESG commitments, guided by a clear roadmap, and with a focus on contributing to a sustainable future for people, communities and the planet.

Pillar Topic Target Fiscal 2025

achievementsTrusted

partnerEthics and Compliance by Fiscal 2026

>99% employees trained in responsible business conduct(1)98.7% Individuals Gender Balance by Fiscal 2026

At least 42% of women in leadership positions(2)40.6% Local

communitiesSupporting Merchants by Fiscal 2026

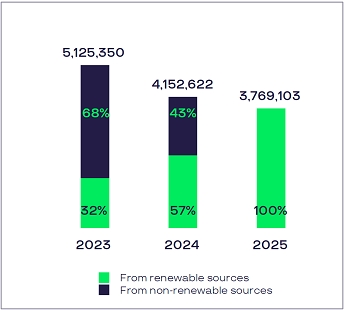

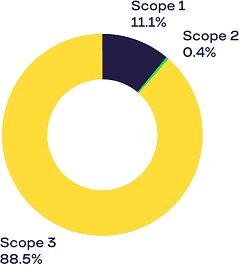

€8bn Business volume reimbursed benefiting small and medium business merchants(3)€7.0bn Environment Net-Zero by Fiscal 2025

100% renewable electricity in all Pluxee offices(4)by 2030

65% absolute reduction in GHG emissions(5)100%

-23%

- For information on how this indicator is calculated, see section 5.7.1.1 Governance -Trusted Partner

- Leadership positions include Group CEO, Pluxee’s Executive Committee and their direct reports, excluding executive assistants, and Local Leadership (members of country-level executive committees)

- At constant Fiscal 2023 foreign exchange rates

- For the definition of renewable electricity see section 5.7.1.1 Environment - Energy

- GHG: Market-based greenhouse gas emissions reduction from Fiscal 2017 baseline; For further details on Pluxee’s net-zero trajectory and related targets, see section 5.5.1

-

1.1 Introduction to Pluxee

1.1.1 A global leader in Employee Benefits and Engagement

The Pluxee Group is an Employee Benefit and Engagement solutions pure player with significant Public Benefit activities.

As of August 31, 2025, Pluxee is present in 281 countries and is the second largest provider worldwide of Employee Benefit and Engagement solutions. The group is the largest player in 17 countries in at least one benefit category locally, according to available public and market sources.

The Group sells a comprehensive suite of benefits to more than half a million clients across the globe, comprised of public and private companies spanning all sizes and industries, as well as public institutions.

Pluxee helps clients boost employee engagement by offering a suite of benefits that enhance compensation packages while remaining efficient for employers. Operating in a B2B2C model, Pluxee reaches 37 million+ consumers through its client base. These consumers have access to Pluxee’s proprietary merchant network comprised of 1.7 million+ partners and 600 delivery and e-commerce platforms (as of August 31, 2025).

Reflecting Pluxee’s mission to “bring to life a personalized and sustainable employee experience at work and beyond”, the Group provides a wide range of benefits through its rich network of merchant partners who offer meal, food, gift, employee mobility, health, financial well-being, leisure and personal growth, among others, for all stages of work and life.

Beyond giving clients a way to offer all employees a comprehensive suite of benefits — enhancing purchasing power, healthy lifestyles, work-life balance, and eco-responsibility at the collective level — Pluxee also provides Reward & Recognition solutions to act at the individual level. In addition, through partnerships such as The Happiness Index, Pluxee equips clients with tools to measure and drive engagement. Together, these solutions help companies attract, grow, and retain talent.

Driven by people and enabled by technology, Pluxee has developed an advanced and rapidly evolving digital ecosystem integrating three groups of stakeholders: clients, consumers, and merchants. This highly interconnected ecosystem is at the heart of Pluxee’s B2B2C business model.

This ecosystem provides a compelling consumer experience, seamlessly supporting daily recurrent benefit usage through meal, food, and mobility benefits or more occasional interactions (mental and physical well-being, leisure, etc.). Consumers use pre-paid benefit cards, often fully virtualized, to make purchases at affiliated merchants’ points of sale, both physical and online. With 94%, on average, of its total business volumes issued (BVI) digitalized during Fiscal 2025, Pluxee manages more than 4 million transactions daily.

Pluxee also provides digital interfaces and solutions to its clients to optimize their experience at each stage of their journey. These tech-enabled tools provide a smooth experience when onboarding new clients, interacting with existing ones, or assisting them when they consider purchasing new benefits. The Group has developed optimized client journeys for small and medium enterprises to facilitate their access to benefit products. Its digital solutions also enable merchants to go fully digital, from affiliation to virtual payment and reimbursement tracking.

Pluxee is a trusted partner to local businesses, fostering sustainable growth by helping merchants attract new consumers, supporting their daily operations, and strengthening client loyalty.

Additionally, Pluxee leverages its know-how to help local authorities and public institutions reach people in need, facilitating the distribution of social benefits. The Group’s services help public authorities promote the welfare of vulnerable residents by providing access to food, transport, and other social aid services. The Group also provides efficient means for public authorities to channel specific purpose funds to targeted groups of individuals to encourage specific spending behaviors (eco-responsible, buying local, etc.). Pluxee thereby enhances the effective distribution of public programs, leading to positive outcomes for a broad range of stakeholders.

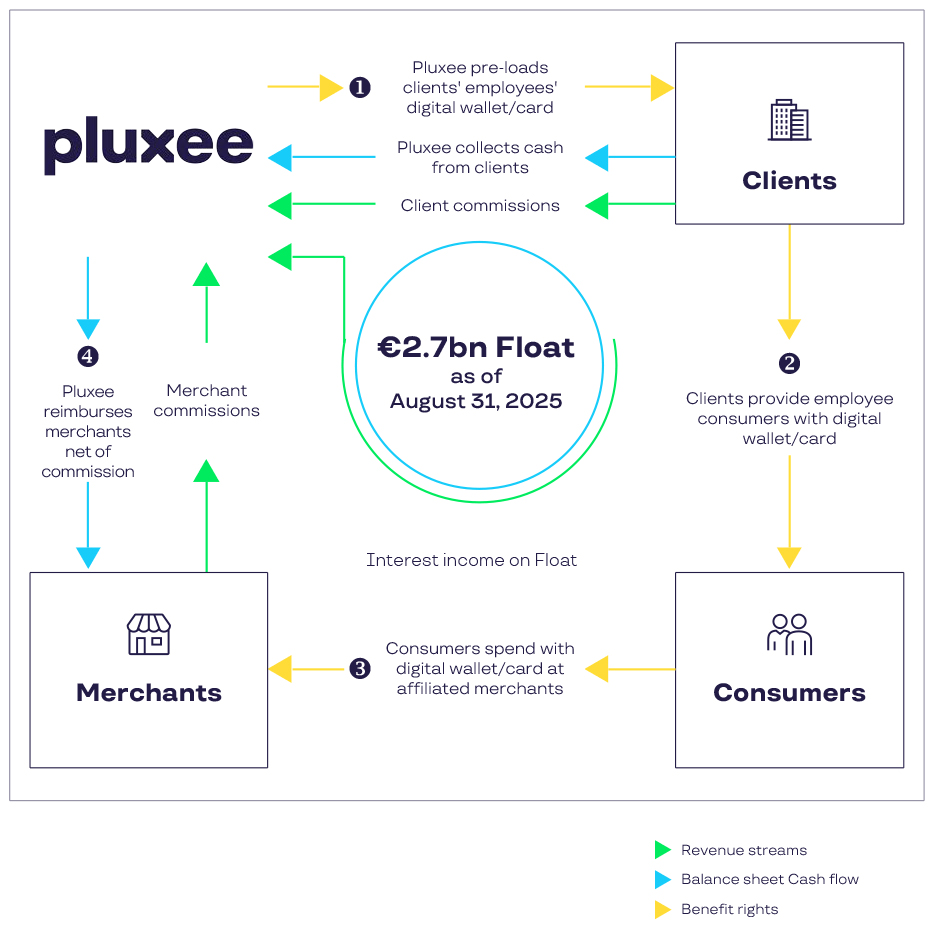

The Group’s business model is based on corporate clients, who load funds representing the amount of benefits that their employees will spend, onto a Pluxee account. Funds from this account are paid out to merchants progressively as employees use their benefits in the merchant network. This pre-paid B2B2C model provides revenue sources from clients, merchants, and Float investment. It leads to a platform that initially requires volumes sufficient to amortize fixed costs, and eventually becomes scalable with growth (for more on Pluxee’s cash-generative business model, including an explanation of Float, see section1.3).

-

1.2 The Employee Benefit and Engagement market

The Employee Benefit and Engagement market presents a very attractive growth opportunity, fueled by three powerful structural elements:

- A sizable addressable market with significant potential for increased market penetration;

- Robust, sustained market growth underpinned by mid-term positive macroeconomic trends in key countries, and the continuous growth of the employee population, particularly in developing markets;

- The combination of compelling megatrends and supportive regulation in key markets, including an upward trend in the value of authorized tax exemption thresholds.

These macroeconomic expectations and global trends lead to an estimated annual growth rate for the Meal & Food Benefit direct captured market in a range of 7 to 9% for Fiscal 2024 to Fiscal 2026.

Specific dynamics within job markets in Pluxee’s countries, and evolving consumer trends also underpin the growth case for the services Pluxee offers:

- the increase in demand for enhanced employee engagement solutions driven by competition for talent among companies;

- the growing adoption of employee benefits, driven by increasing penetration of the small and medium-sized enterprise segment;

- the growth in demand for flexibility among increasingly empowered employees;

- the positive impact of the shift to more work-from-home, with an evolution toward digital meal benefits or hybrid offers.

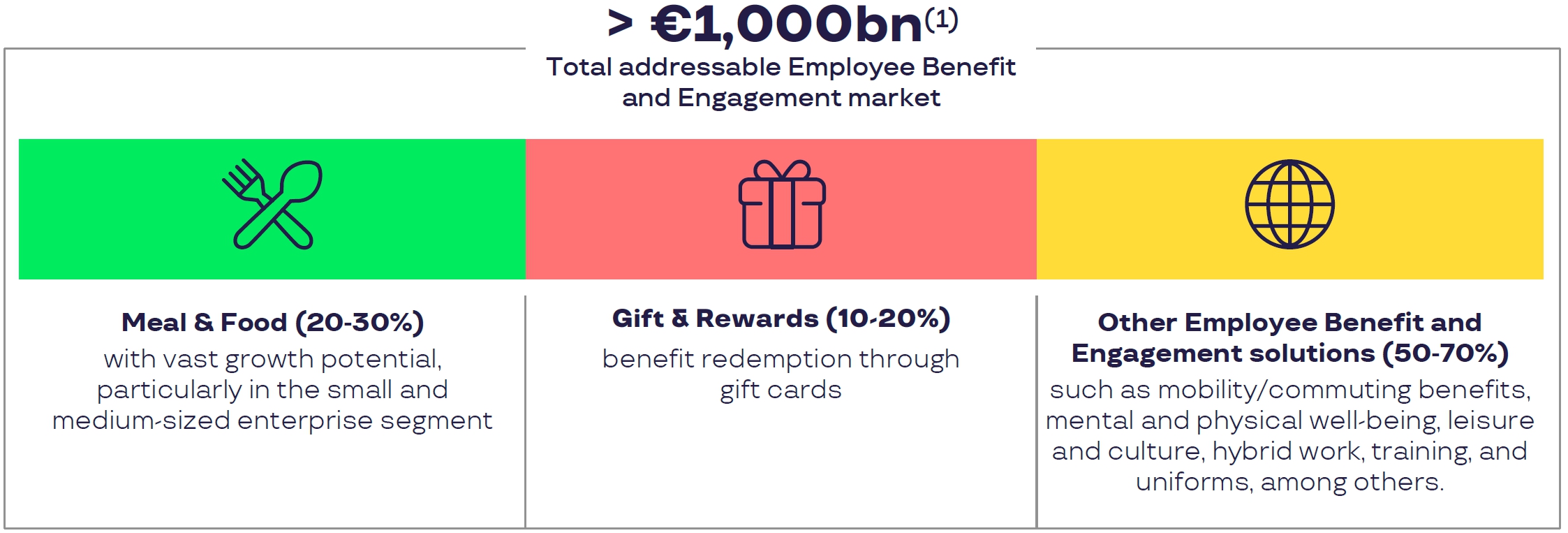

1.2.1 A large and underpenetrated market

- Total addressable Employee Benefit and Engagement market: Aggregate BV of all companies that are eligible to provide employee benefits, including those that do not offer these services to their employees.

The size of the global addressable Employee Benefit and Engagement market in Fiscal 2025 was estimated to be more than 1,000 billion euros in business volume. This estimate takes into account the aggregate potential business volume of all companies that are eligible to grant employee benefits (regardless of whether or not they actually offer such benefits to their employees), calculated on the basis of:

- the estimated maximum allowance that could be granted to an employee as a benefit in a given country;

- multiplied by the total number of employees that are eligible to receive employee benefits in that country.

The markets for both employee benefits and engagement are estimated to be largely underpenetrated and to be growing dynamically and continuously.

Notably in Meal & Food, accounting for 20 to 30% of the total Employee Benefit and Engagement business, the market is estimated to grow on a 7 to 9% CAGR over Fiscal 2024 to Fiscal 2026, with a penetration rate that stands at approximately 25% of the total addressable market. Within Meal & Food, the small and medium-sized enterprise segment has a significantly lower penetration rate than larger companies, and provides a particularly compelling growth opportunity.

-

1.3 Pluxee’s cash-generative and scalable business model

- 500,000+ clients, comprised essentially of large, small, and medium-sized enterprises, whose human resources departments contract benefit products and services on behalf of their employees;

- 37 million+ consumers, comprised of the employees who are granted Pluxee-branded benefits by their employers;

- 1.7 million+ merchants sell their products which are redeemed through Pluxee’s various benefit products and solutions.

Pluxee operates a prepaid business, collecting cash from clients when they order the Group’s solutions, and then loading the cards and digital wallets of the clients’ employees, the end-consumers. The amount loaded onto cards and digital devices corresponds to the Group’s business volumes issued (BVI). The end-users, or consumers, then spend their benefits within the merchant network. Finally, the Group reimburses the merchants (business volume reimbursed, or BVR). This model generates three main sources of revenue:

- commissions paid by clients;

- commissions paid by merchants;

- revenue generated by the investment of the Float1.

The Float is made up of the cash collected from clients before employee benefits are issued. It remains on Pluxee’s balance sheet until these funds are reimbursed to the merchants where the end-consumers disbursed their benefits. At August 31, 2025, the Float stood at 2.7 billion euros.

Pluxee thus operates a highly scalable B2B2C business model, in which more business volume leads to revenue growth, which in turn positively impacts Pluxee’s profitability.

-

1.4 A value proposition for all business stakeholders

1.4.1 A customized value proposition

Pluxee is a tech-enabled partner, offering a value proposition that fits the needs and requirements of each stakeholder in its B2B2C ecosystem.

Clients

Merchants

Consumers Pluxee helps clients build a more engaged workforce

- Provide tax-effective, compliant, and secure employee benefit solutions

- Manage collective and flexible benefits in one place

- Reward and recognize individual contributions

- Measure and drive engagement

Pluxee is a trusted partner that generates sustainable growth

- Attract new consumers and generate incremental revenue

- Predictable traffic with access to recurring consumers

- Augmented digital presence and local visibility

- Support daily operations

Pluxee enhances the everyday experience of employees

- Augment purchasing power

- Provide a broad choice of merchant options

- Provide multiple consumption and payment possibilities as well as simplified expense processes

-

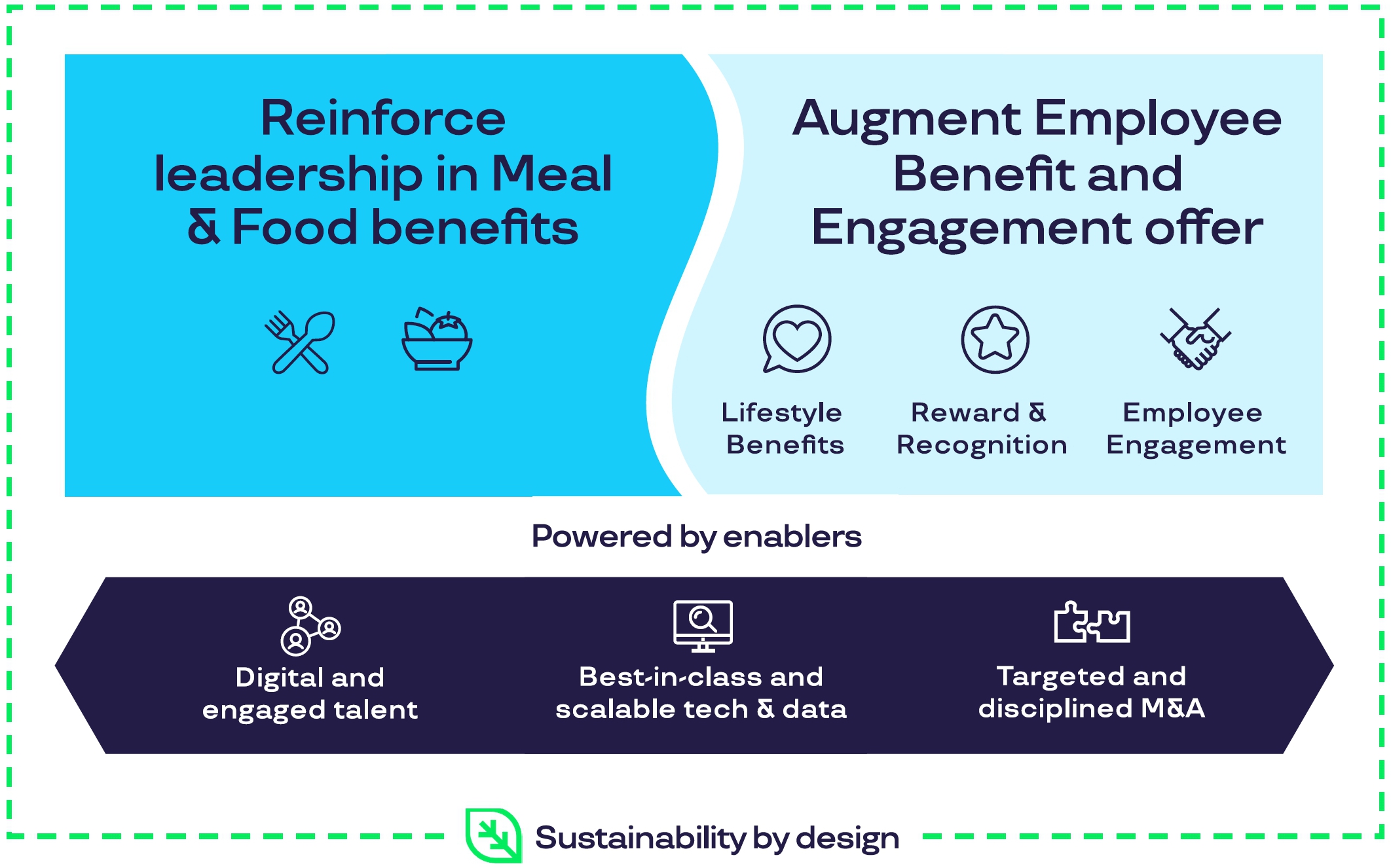

1.5 Pluxee’s profitable growth strategy

Since January 2024, Pluxee has been committed to executing the strategic roadmap presented at its first Capital Markets Day.

The Group’s strategic plan aims to drive ongoing profitable growth by combining global scale and deep local roots to further address a large underpenetrated market with high growth potential.

Pluxee’s competitive advantages enable the Group to accelerate the expansion of its Employee Benefit and Engagement products and solutions.

1.5.1 Key pillars and foundational enablers

To consolidate and amplify its strong market position and to continue to drive profitable growth, Pluxee builds the expansion of its business on two key strategic pillars:

- Pluxee’s strong leadership position in the Meal & Food benefit market;

- Pluxee’s Employee Benefit and Engagement offering beyond Meal & Food.

-

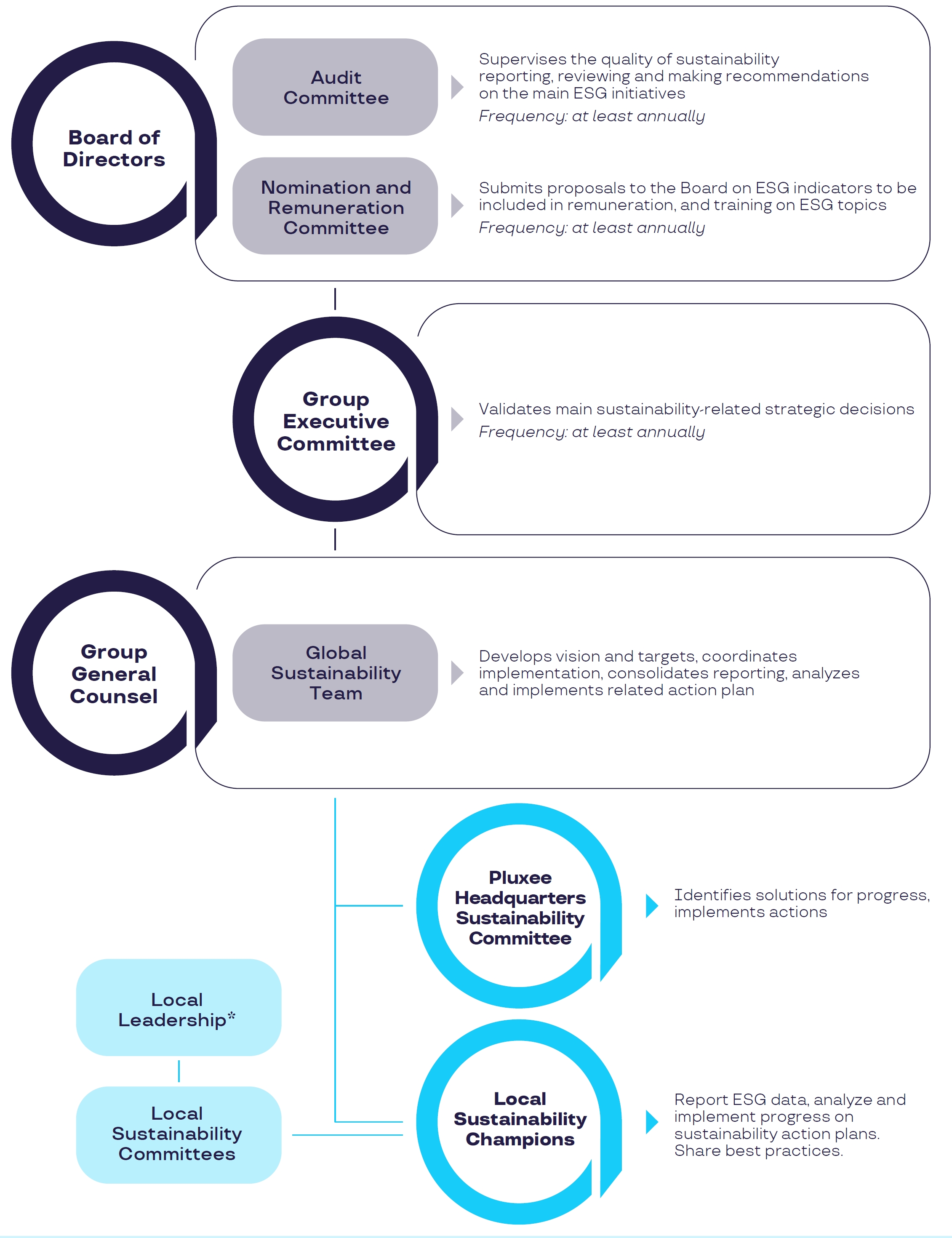

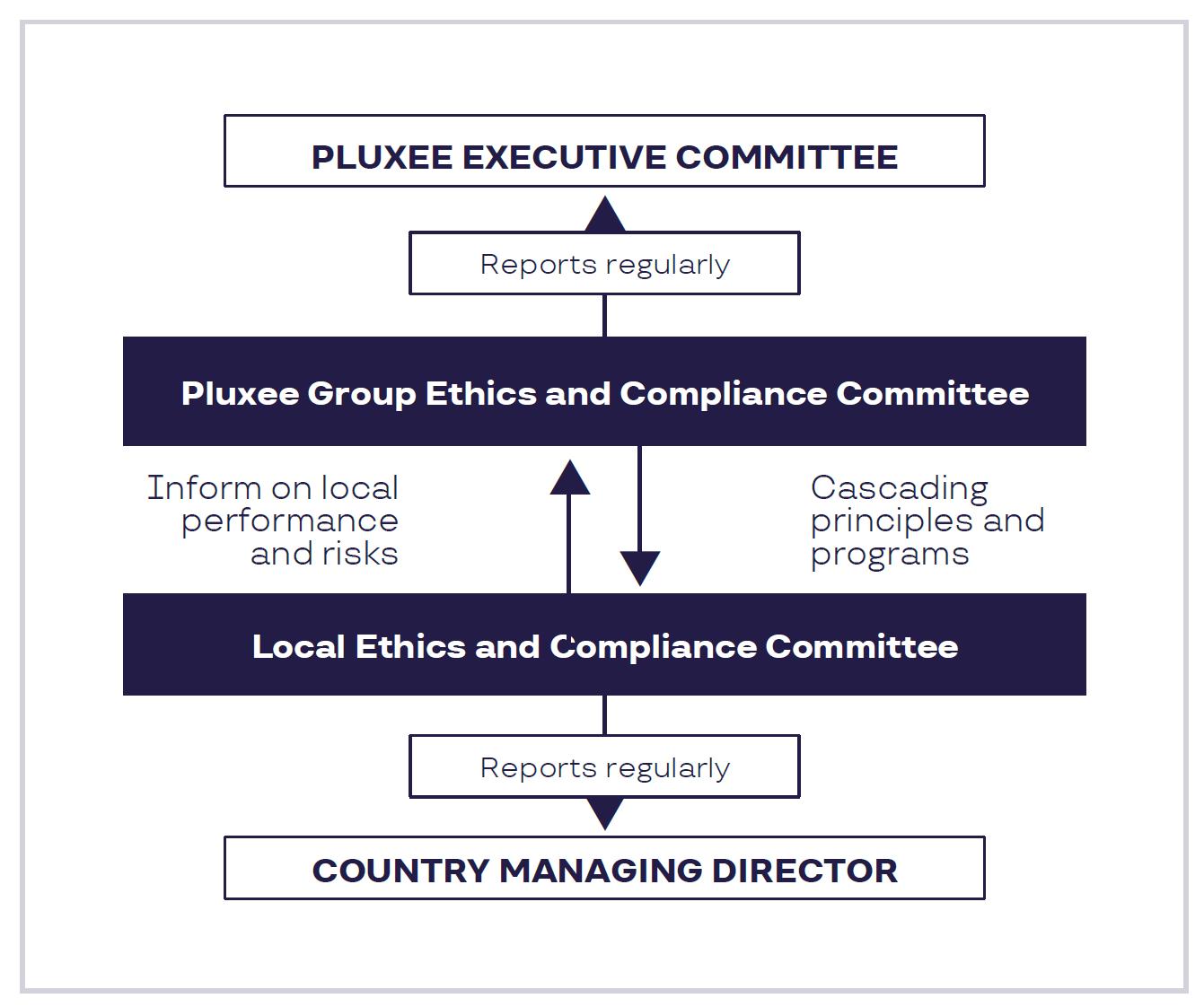

2.1 Overview of Pluxee’s governance

This section of the Annual Report describes relevant elements of Pluxee’s corporate governance practices and provides the information required by the Dutch governmental Decree on Corporate Governance (Besluit inhoud bestuursverslag). This section also includes an explanation of how Pluxee applies the principles and best practices of the Dutch Corporate Governance Code (the “Code”), and the Dutch governmental Decree on article 10 of the Takeover Directive 2004/25 (Besluit artikel 10 overnamerichtlijn).

In the context of this Annual Report, which addresses the fiscal year starting on September 1, 2024, Pluxee refers to its adherence to the principles and best practices of the version of the Code dated December 20, 2022. An updated version of the Dutch Corporate Governance Code dated March 20, 2025 (the “Code 2025”) applies to financial years starting on or after January 1, 2025, and will thus be applicable from Pluxee’s Fiscal 2026 Annual Report. The Code is publicly available on the website of the Dutch corporate governance code monitoring committee at www.mccg.nl.

Pluxee N.V. is a public limited liability company (naamloze vennootschap) governed by the laws of the Netherlands (in particular volume 2 of the Dutch civil code), the Code (on a comply or explain basis) and by its articles of association (the “Articles of Association”). The corporate seat of the Company is in Amsterdam, the Netherlands. Since its incorporation, the Company has, and intends to continue to have, its place of effective management and sole registered location in France, moved during Fiscal 2024 to the Company’s address, 16 rue du Passeur de Boulogne, 92130 Issy-les-Moulineaux, France. The Articles of Association are publicly available on Pluxee N.V.’s website at www.pluxeegroup.com/governance-documents.

Pluxee N.V. is subject to various legal provisions of the Dutch financial supervision act (Wet op het financieel toezicht) and of the Dutch financial reporting supervision act (Wet toezicht financiële verslaggeving). As such, disclosure and reporting of share ownership by Pluxee’s shareholders is regulated by various provisions of Dutch law, as described in the listing prospectus dated January 10, 2024. In addition, given that Pluxee N.V.’s shares trade on the regulated market of Euronext Paris, the Company is also subject to certain French laws and regulations, and is therefore subject to the oversight of both the Dutch AFM and the French AMF, notably with respect to the European market abuse prevention regulations. Overall, as a listed issuer incorporated and listed in the European Union, Pluxee N.V. is subject to high standards of corporate governance and regulation.

-

2.2 Board of Directors

2.2.1 Board rules and functioning

In accordance with its Articles of Association, Pluxee has a one-tier Board of Directors consisting of one Executive Director and nine Non-Executive Directors. The Board of Directors appointed the Executive Director as Executive Chair, as well as a Lead Director from among the independent Non-Executive Directors who serves as the chairperson (voorzitter) of the Board under Dutch law and within the meaning of the Code. The Board did not designate any vice chair. The Company adopted this governance structure on January 31, 2024 in the context of the Spin-off. Prior to that date the Company had a sole managing director.

- define, in cooperation with the Chief Executive Officer, the strategy and propose it to the Board for approval;

- demonstrate the highest values of integrity and probity, giving very clear guidance and expectations regarding the Company’s culture and values, and dedicate sufficient time, energy and attention to ensure the diligent performance of its duties;

- ensure, in cooperation with the Lead Director, that work and functioning of the Board meets the defined standards of corporate governance;

- assume all relevant responsibilities defined in the Board Rules; and

- supervise and support the Chief Executive Officer.

- the Non-Executive Directors have proper contact with the Executive Director, and the General Meeting;

- there is sufficient time for deliberation and decision-making by the Board and that the Directors receive all information that is necessary for the proper performance of their duties in a timely fashion;

- the Board and the Committees have a balanced composition and function properly;

- the functioning of individual Directors is reviewed at least annually;

- the Directors follow their induction program, as well as their education or training program;

- the Executive Director performs activities in respect of corporate culture;

- the Board is responsive to signs of misconduct or irregularities from the Company’s business; and

- effective communication with the Company’s shareholders is assured.

The Board is entrusted with the management of the Company subject to the restrictions contained in the Articles of Association and the law. This includes setting the Company’s policy and strategy. The Board may allocate its duties among the Directors by means of the Board Rules or otherwise in writing, with due observance of any limitations provided for by law or in the Articles of Association. The Board may determine in writing, in or pursuant to the Board Rules or otherwise pursuant to resolutions adopted by the Board, that one or more Directors can validly pass resolutions in respect of matters which fall under his/ their duties. In performing their duties, Directors shall be guided by the interests of the Company and of the business connected with it.

The Executive Director, i.e., the Executive Chair, shall be entrusted primarily with the Company’s day-to-day operations and the Non-Executive Directors shall be entrusted primarily with the supervision of the performance of the duties of the Directors as specified in the Articles of Association and the Board Rules. The Non-Executive Directors also perform any duties allocated to them under, or pursuant to, the law and the Articles of Association.

The power to represent the Company vests in the Board of Directors and in the Executive Chair individually. The Board vested the salaried Chief Executive Officer, Aurélien Sonet, with representation powers pursuant to a power of attorney included in the Board Rules. The Chief Executive Officer operates in close coordination with the Executive Chair, who in turn has limitations of authorities from the Board of Directors. These limitations and authorities are reflected in the Board Rules (see section 2.2.1.3).

- manage and lead the Company in its day-to-day operations and monitor the operational and financial performance of the Subsidiaries;

- be responsible for delivering financial and extra-financial performance of the Company and its Subsidiaries in line with the Company’s business plan;

- manage the implementation and proper functioning of risk management and control systems within the group;

- define, in cooperation with the Executive Chair, the Company’s strategy and propose it to the Board for approval;

- implement the Company’s Board-approved strategy and prepare and set up the necessary KPIs for monitoring the implementation and achievement of the Company’s Board-approved strategy;

- prepare the draft of the annual accounts with the corresponding annual report, in cooperation with the Chief Financial Officer of the Company;

- ensure compliance by the Company and its subsidiaries with laws and regulations, as well as applicable policies and codes of conduct;

- Demonstrate the highest values of integrity and probity, giving very clear guidance and expectations regarding the Company’s culture and values.

The Board, at its meeting dated July 2, 2025, amended the Board Rules and the respective layers of operational responsibilities of the Executive Chair and of the Chief Executive Officer, under the oversight of the Board, as summarized below. In case the thresholds indicated for the Executive Chair are exceeded, then the corresponding financial commitment becomes subject to the prior approval of the Board.

Main financial commitments and applicable thresholds (in euros) Chief Executive

OfficerExecutive

Chair(1)Investments and divestments, including through mergers, acquisitions, joint-venture transactions, sales and purchases of tangible and intangible assets, in line with the Company’s Board-approved strategy ≤10,000,000

(per project)≤30,000,000

(per project)Settlements (in litigation matters) ≤10,000,000 ≤20,000,000 Financing or refinancing arrangements (including through loans, facilities, notes and commercial papers issuance) ≤50,000,000 ≤100,000,000 Sureties, guarantees or similar undertakings ≤10,000,000(2) ≤20,000,000(2) “Tech projects”, if the total estimated project cost at completion (whether one-off or multi-year) is equal to or below ≤15,000,000 ≤25,000,000 Supplier agreements, if the total contract value (actual or estimated, whether one-off or multi-year) is equal to or below ≤10,000,000 ≤15,000,000 Leasing and/or lease agreements, if the total contract value of such leasing/lease (excluding tax, charges and indexation) is equal to or below ≤5,000,000(2) ≤10,000,000(2) - In case the thresholds indicated for the Executive Chair are exceeded, then the corresponding financial commitment becomes subject to the prior approval of the Board.

- The Board is also competent to decide if the term of such commitments exceeds 10 years.

Pursuant to the Articles of Association, the Board has established Board Rules concerning its organization, decision-making and other internal matters, with due observance of the Articles of Association. In performing their duties, the directors act in compliance with the Board Rules. The Board Rules, as amended by the Board during Fiscal 2025, are available on the Company’s website (www.pluxeegroup.com/governance-documents).

This section deals with the rules included in the Articles of Association and the Board Rules which support and apply to the above-mentioned governance structure of the Company.

The Articles of Association provide that the Board consists of one or more Executive Directors and one or more Non-Executive Directors. The Board shall be composed of individuals. The Board shall determine the number of Executive and Non-Executive Directors. Pursuant to the Board Rules, the Board shall be composed of at least eight Directors, consisting of one or two Executive Directors and, for the remainder, of Non-Executive Directors.

The Board may designate as Chief Executive Officer an Executive Director or any other employee or officer of the Company or Group Companies. The Board may also designate an Executive Director as Executive Chair. The Board shall further designate a Non-Executive Director as the Chair of the Board (voorzitter) for purposes of Dutch law. Such Non-Executive Director will carry the title “Chair”. However, if, and for as long as an Executive Chair is elected, the Chair of the Board (voorzitter) for purposes of Dutch law will carry the title of “Lead Director” instead of the title “Chair”. Certain duties and powers of the Chief Executive Officer, the Executive Chair and the Chair or Lead Director, as applicable, are set out in the Articles of Association and the Board Rules. If and for as long as (i) a Chief Executive Officer has been elected who is not an Executive Director and (ii) an Executive Chair has been elected, the Board’s tasks and responsibilities, as well as its decision-making authority, in respect of the matters that are delegated to the Chief Executive Officer pursuant to the Board Rules are instead delegated to, and shall be resolved upon by, the Executive Chair. The Executive Chair shall then authorize the Chief Executive Officer to implement and put into effect such matters, under the supervision of the Executive Chair, and ensure that the appropriate checks and balances are put in place to ensure appropriate oversight over the Chief Executive Officer’s exercise of its authorities set out in the Board Rules. The Board may designate one or more other Non-Executive Directors, other than the Chair or Lead Director, as applicable, as Vice-Chair.

The General Meeting shall appoint the Directors and may at any time suspend or dismiss any Director. Upon the appointment of a person as a Director, the General Meeting shall determine whether that person is appointed as Executive Director or as Non-Executive Director. In addition, the Board may at any time suspend an Executive Director. A resolution of the General Meeting to suspend or dismiss a Director can be passed by simple majority of votes cast representing more than one third of the issued share capital. A second meeting as referred to in article 2:120(3) BW cannot be convened. If a Director is suspended and the General Meeting does not resolve to dismiss him or her within three months from the date of such suspension, the suspension shall lapse.

Pursuant to the Board Rules, a person may be appointed as Executive Director or Non-Executive Director for a term up to the end of the annual General Meeting held in the fourth calendar year after the year of appointment, without limitation on the number of consecutive terms which an Executive Director or Non-Executive Director may serve. The Board drew up a rotation schedule for the Non-Executive Directors which may evolve over time, to achieve a staggered end to terms of office. In this regard, upon the recommendation of the Nomination and Remuneration Committee, and with a view to ensuring an orderly succession plan, the Board has decided to propose, when appropriate, the renewals of certain terms of office before they reach their official end.

Resolutions of the Board shall be passed by a simple majority of votes cast, unless the Board Rules provide otherwise. Each Director entitled to vote may cast one vote in the decision-making of the Board. Where there is a tie in any vote of the Board, the Executive Chair has a casting vote, except for certain resolutions in which the Executive Chair shall not take part as set forth in the Board Rules (§6.15 referring to article 19.6 of the Articles of Association): the determination of the compensation of Executive Directors; and the instruction of an auditor to audit the annual accounts if the General Meeting has not granted such instruction. Otherwise, the relevant resolution shall be rejected.

Under the current set up, the Board shall meet as often as the Lead Director or the Executive Chair or any group of three directors jointly deem(s) necessary or appropriate and at least quarterly. A Board meeting may be convened by, or at the request of, the Lead Director, the Executive Chair or a group of three directors jointly by means of a written notice sent to all directors.

The Board’s meetings may take place virtually or at a physical location, and they are normally held at the Company’s offices in France, or another location in France, with the Executive Directors, the Chair or the Lead Director (as applicable), and a majority of directors physically attending. Meetings may only incidentally take place virtually. In compliance with the above principles, the form and location of the meetings will be determined by the Director convening the meeting as desirable given the circumstances.

Subject to the previous paragraph, Directors entitled to vote shall be given the opportunity to attend the meeting of the Board by telephone, videoconference or electronic communication, provided that (i) all participants can hear each other simultaneously, and (ii) Directors are not physically located in the Netherlands during such meeting unless exceptional circumstances require this. The Lead Director or the Executive Chair determines whether exceptional circumstances apply. Directors attending the meeting by telephone, videoconference or electronic communication are considered present at the meeting.

A Director can be represented by another Director entitled to vote holding a written proxy for the purpose of the deliberations and the decision-making of the Board.

The approval of the General Meeting is required for resolutions of the Board concerning a material change to the identity or the character of the Company or the business, including in any event:

- transferring the business or materially all of the business to a third party,

- entering into or terminating a long-lasting alliance of the Company or of a Group Company either with another entity or company, or as a fully liable partner of a limited partnership or general partnership, if this alliance or termination is of significant importance for the Company, and

- acquiring or disposing of an interest in the capital of a company by the Company or by a Group Company with a value of at least one third of the value of the assets, according to the balance sheet with explanatory notes or, if the Company prepares a consolidated balance sheet, according to the consolidated balance sheet with explanatory notes in the Company’s most recently adopted Annual Accounts,

provided that the absence of approval of the General Meeting shall not affect the powers of representation of the Board or of the Directors.

Pursuant to the Articles of Association and the Board Rules, resolutions of the Board may, instead of at a meeting, be passed in writing, provided that all directors are familiar with the resolution to be passed and none of them, insofar as entitled to vote, objects to this decision-making process.

The Nomination and Remuneration Committee oversees the induction and training programs and provides advice on the training plans for Directors. In this regard, various topics are regularly addressed such as strategy, governance, legal affairs, finance, culture, social, sustainability and business specificities.

In Fiscal 2025, all Board members participated in a Board training session focused on Corporate Social Responsibility (including climate change aspects). This session covered the directors’ missions, duties and responsibilities, the specific regulatory environment, as well as the relevant reporting and disclosure requirements in this area.

The Non-Executive Directors also discussed and received regular updates during Board meetings on commercial developments and the competitive landscape, notably including commercial and financial KPIs.

In addition, as part of the Board annual evaluation, each Non-Executive Director is able to identify the aspects on which he or she requires training or education. The Board took into account the results of the annual evaluation for the purpose of the ongoing Director training program (for more information, see section 2.2.3.3).

On July 3, 2024, the Board of Directors adopted “Share ownership guidelines for members of the Board of Directors” whose purpose is to align the directors’ interests with the long-term interests of the shareholders of Pluxee: each member of the Board is expected to buy and own at least 500 ordinary shares by the end of his/her first year on the Board, and to hold them from that date until the end of the term of his/her office with Pluxee. Each Director shall comply with all legal trading obligations/prohibitions as set forth in the “Insider Trading Prevention Policy” as approved by the Board.

The Board carefully considers the various investor policies in this area and has not deemed it necessary at this point to adopt specific guidelines limiting or prohibiting Directors from serving on boards and/or committees of other organizations. Serving on other boards and/or committees shall be consistent with the provisions of the Articles of Association and the Board Rules relating to conflicts of interest, and all applicable laws and regulations. In accordance with the Board Rules, the acceptance by an Executive Director of a position as supervisory director or non-executive director with another company or entity shall be subject to the approval of the Board with a simple majority of Directors’ votes, including a simple majority of the Non-Executive Directors’ votes. A Director shall notify the Board in advance of any other position he wishes to pursue.

Until the end of Fiscal 2025, the Company was not yet subject to Dutch statutory rules on over-boarding. Nevertheless, all Directors comply with the restrictions of Dutch law in respect of the overall number of management and supervisory positions that executive and non-executive directors of a “large Dutch company” may hold: a person may not be appointed as a managing or executive director of a “large Dutch company” if he or she already holds a supervisory position at more than two other “large Dutch companies” or if he or she is the chairperson of the supervisory board or one-tier board of another “large Dutch company”. Also, a person cannot be appointed as a supervisory director or non-executive director of a “large Dutch company” if he or she already holds a supervisory position at five or more other “large Dutch companies”, whereby the position of chairperson of the supervisory board or one-tier board of another “large Dutch company” is counted twice.

-

2.3 Senior management team

The Chief Executive Officer, Mr. Sonet, leads a senior management team, the Executive Committee. This executive team, comprised of 12 senior leaders from across the Group, encompasses a diverse range of educational backgrounds, professional experience, skill sets, nationalities, and age groups. The Executive Committee reflects a diversity of senior management experience gained within large and scale-up companies, French and non-French entities, and companies at different stages of their digital transformation. It is gender-balanced, as 42% of its members are women. The Executive Committee also benefits from a diversity of corporate perspectives. It is comprised of senior executives who held positions of different tenure lengths within the Sodexo Group (prior to the February 2024 Pluxee spin-off), or who had leadership roles at other global corporations before joining Pluxee. All these leaders have significant international management experience.

Aurélien Sonet

Chief Executive Officer

- Pluxee CEO since 2017, confirmed in his position post-rebranding of Sodexo Benefits and Rewards Services (BRS).

- 24-year tenure at Sodexo Group.

- From 2017 to 2023, CEO of Sodexo’s BRS business and member of Sodexo Group’s Leadership Team. Spearheaded digital transformation, drove profitable growth, and secured a leading global position with international operations.

- From 2013 to 2017, relocated to Singapore to develop Sodexo Group’s business in the Asia Pacific region; promoted to Region Chair in 2015.

- From 2010 to 2013, Global Executive VP for Strategy, Brand and Communications of the Sodexo Group.

- From 2000 to 2010, held roles of ascending responsibility at Sodexo in finance, strategic planning, marketing and communication, and general management.

- Senior consultant at Deloitte (1997-2000).

- Graduate of École Centrale de Lyon.

Béatrice Bihr

Executive Vice-President Group General Counsel

- Joined Pluxee as EVP and Group General Counsel in September 2023. Oversees Legal, Sustainability, Ethics and Compliance, Public Affairs, Data Protection. and Security and Safety.

- Served as EVP and Group General Counsel for world-leading shipping and logistics CMA CGM in 2023, and Servier Pharmaceuticals from 2021 to 2023.

- From 2014 to 2021, General Counsel at Teva Santé.

- Admitted to the bars of Paris and New York; she specialized in M&A for 10 years early in her career.

- Deep experience leading large and diverse teams to drive transformation in complex organizations.

- Graduate of HEC Business School, Sciences Po Paris, Université de Paris I (Sorbonne), and University of Chicago Law School (LLM),

Alexandre Cotarmanac’h

Group Chief Product Officer

- Joined Pluxee in February 2024 as Group Chief Product Officer.

- From 2021 to 2024, Chief Product and Technology Officer (CPTO) at Stuart, the leading last-mile B2B logistics company in Europe, where he led the transformation of Tech, including a new offering for large grocery retailers in the UK and France.

- From 2018 to 2021, CPTO at Dunnhumby’s Media business unit, producing best-in-class offerings for retail media.

- From 2015 to 2018, led Publishers Products at Criteo (serving billions of targeted ads per day, covering half of the global internet population).

- Began his career in research at the French telecom leader, Orange, authoring 10+ patents.

- Graduate of École Polytechnique and Corps des Mines.

Manuel Fernández Amezaga

Chief Revenue Growth Officer for Hispanic Latin America

- In March 2024 named to the role of Pluxee Chief Revenue Growth Officer, Hispanic Latin America, and to Pluxee’s Executive Committee.

- 14-year tenure at Pluxee (formerly, Sodexo BRS).

- From 2020 to 2024 was CEO of Pluxee Romania and Bulgaria, based in Bucharest, driving 250% growth, accelerating digitalization, and establishing Pluxee’s leadership in the Romanian payment market.

- From 2017 to 2020 was CEO of Pluxee Philippines, overseeing digitalization of products and processes, and digital transformation

- In 2010 joined Sodexo BRS Spain as Commercial Director, leading process overhauls, business development and restructuring.

- From 1997 to 2010, early career at American Express in Greece, moving to the company’s Global Business Travel in Spain, and named Commercial Director in 2008.

- Holds a law degree from CEU University in Madrid and a PDD from IESE Business School.

Sébastien Godet

Chief Revenue Growth Officer for Asia, Middle East, Africa and Continental Europe

- Since 2024, Pluxee’s Chief Revenue Growth Officer for Asia, the Middle East, Africa, and Continental Europe, based in Paris; member of Pluxee’s Executive Committee since 2012.

- 14-year tenure at Pluxee (formerly, Sodexo BRS).

- From 2020 to 2024, Pluxee’s Asia-Middle East-Türkiye-Africa President.

- From 2015 to 2020, Sodexo BRS Asia President, based in Singapore.

- In 2010 joined Sodexo BRS as General Manager B2C in the Gift business unit; appointed Gift Market President in 2012.

- Early career in various roles in Purchasing, Marketing, and Operations between 2000 and 2008 at PPR (now Kering); VP Marketing and Development at Accor Services (now Edenred), and General Manager Purchasing, IT and Offer Marketing at the Altavia Group.

- Graduate of HEC Business School.

Malena Gufflet

Managing Director Pluxee France

- Managing Director of Pluxee France since July 2023; member of Pluxee’s Executive Committee since March 2024.

- From 2020 to 2023 was CEO of Booking.com France.

- From 2016 to 2020 was Commercial Director of events sector company La Maison Options.

- From 2007 to 2016 held various positions at AccorHotels in Paris, being named Director of Sales, Business Travel France, and later, Sales Director of Adagio Aparthotels.

- Brings extensive digital and change management expertise to the Pluxee Group.

- Holds a Master’s Degree from the Leonardo da Vinci School of Management in Paris; attended Coventry University in England.

Thierry Guihard

Managing Director Pluxee Brazil

- Managing Director, Pluxee Brazil since January 2021, driving digital transformation and introducing new products; member of Pluxee’s Executive Committee since March 2024.

- 28-year tenure at Pluxee (formerly, Sodexo BRS).

- From 2017 to 2021, CEO of Sodexo BRS Mexico, and from 2008 to 2017 CEO of Sodexo BRS Chile, leveraging deep expertise in the Latin American benefits market.

- Joined Sodexo BRS Mexico in 1996 as Marketing Manager and later took on various senior marketing roles in Central and Western Europe and Latin America.

- Board Member of the Brazilian Association of Worker Benefits Companies (ABBT) and Foreign Commerce Adviser for France - Conseiller du Commerce Extérieur de la France (CCEF).

- Graduate of Paris ESLSCA Business School; holds a Master’s Degree in International Management from IAE France.

Stéphane Lhopiteau

Group Chief Financial Officer (CFO)

- Pluxee Group Chief Financial Officer since July 2023.

- From 2019 to 2022, Managing Director Finance at Diot-Siaci, a leader in insurance and social protection brokerage.

- From 2015 to 2019, Chief financial and legal officer of Areva Group (now Orano Group), a large player in the nuclear energy space; contributed to Areva’s turnaround.

- From 2011 to 2015, Deputy CFO, and later SVP Performance and Business Services at Thales Group, leading major transformation projects.

- From 2008 to 2011, CFO for DCNS (today Naval group), a European leader in the naval defense sector.

- From 2004 to 2008, Head of Business Development and Finance at Morina Baie Biscuits (now Saint-Michel Biscuits).

- Early career, from 1994, at Arthur Andersen where he made partner in 2002, in various audit and consulting positions.

- From 1992 to 1994, co-founder of Anthyllis Communication, a marketing and publishing agency.

- Graduate of HEC Business School.

Viktoria Otero del Val

Group Chief Strategy, Marketing and Sales Officer, & Chief Revenue Growth Officer for the U.S. and UK

- [11 years of experience at Sodexo Group, including 6 years at Pluxee (formerly, Sodexo BRS).]

- In 2019 joined Pluxee (formerly, Sodexo BRS) as SVP Strategy, Product and Customer Experience, with a focus on digital transformation.

- From 2017 to 2019, SVP Strategy, M&A and New Business Initiatives at Thales Alenia Space.

- From 2012 to 2017, Sodexo’s VP Group Strategic Planning, and later Director for Commercial Development and Innovation for Sodexo Corporate Services in France.

- Early career as consultant at McKinsey & Company, followed by positions in Strategic Planning and Marketing at EDF.

- Graduate of Harvard College and Harvard Business School; holds a Master’s Degree in Political Science from the Central European University.

Cecilia de Pierrebourg

Group Chief Communications Officer and Chief of Staff

- Joined Pluxee in September 2023 as Group Chief Communications Officer and Chief of Staff.

- From 2018 to 2023 served as Global Communications and Brand Director at Ipsos.

- From 2007 to 2018 held several roles of ascending responsibility at Danone: Senior Manager, International Coordination and Corporate Communication (2007-2008), Director of External Communications, Asia Pacific (2019-2012), Global Communications Director, Danone Dairy (2012-2016), and Global Director Corporate Affairs Network and Content (2016-2017).

- Began her career with the global communications firm Burson Marsteller (currently Burson) managing international accounts on corporate issues and crises in Buenos Aires and Paris.

- Graduate of Sciences Po Paris (MBA) and Universidad Belgrano de Buenos Aires in Political Science.

Laure Pourageaud

Group Chief Human Resources Officer

- Since 2019, Chief Human Resources Officer of Pluxee (formerly Sodexo BRS) and member of its Executive Committee.

- Six-year tenure at Pluxee, formerly Sodexo BRS.

- In 2018 joined TalentSoft, a French scale-up, as Chief People Officer.

- From 2001 to 2017 held roles across various functions and of ascending responsibility at Sage, a UK software multinational. Roles included SME Product and Service Marketing, Director of Human Resources France, and in 2011, Chief People Officer Europe, overseeing 7,500+ employees.

- Early career in the management of apprenticeship schools.

- Member of the board of directors of humanitarian and cultural associations.

- Holds master’s degrees in Sociology and Political Science from Université Paris 1 Panthéon Sorbonne.

Gabriel Rotella

Group Chief Information Officer (CIO)

- Since 2019, Chief Information Officer (CIO) and member of Pluxee’s (formerly, Sodexo BRS) Executive Committee.

- Six-year tenure at Pluxee (formerly, Sodexo BRS).

- From 2017 to 2019, Group CIO at agri-food Savencia, driving the group’s IT transformation.

- From 2010 to 2017 roles of ascending responsibility at Pernod Ricard, ultimately as Global VP IT Solutions from 2014 to 2017.

- From 2004 to 2010 Information Systems Senior Manager at LVMH, after a role as Information Systems Head at Moët Hennessy in Argentina from 2000 to 2004.

- Early career in Argentina in Finance functions at various multi-nationals.

- Graduate of CEMA (MBA) and Insead Business School.

-

2.4 Shareholder rights

2.4.1 Rights attached to shares

The Ordinary Shares are ordinary shares in the issued and outstanding share capital of Pluxee with a nominal value of 0.01 euro each. In accordance with the Articles of Association, they rank pari passu with each other and holders of Ordinary Shares are entitled to dividends and other distributions declared and paid on them, if any. Each Ordinary Share carries dividend rights and entitles its holder to attend and to cast one vote at any General Meeting of the Company’s shareholders. There are no restrictions on voting rights attached to the Ordinary Shares.

Each holder of Ordinary Shares (a “Shareholder”) holding their Ordinary Shares in pure administrative form (nominatif pur) may at any time elect to participate in the loyalty voting structure by requesting that Pluxee register all or some of their Ordinary Shares in the loyalty register of Pluxee (the “Loyalty Share Register”). The registration of Ordinary Shares in the Loyalty Share Register blocks such shares from trading. If such number of Ordinary Shares has been registered in the Loyalty Share Register (and thus blocked from trading) for an uninterrupted period of four years in the name of the same Shareholder, such Shareholder becomes eligible to receive Special Voting Shares in the share capital of Pluxee with a nominal value of 0.01 euro each (“Special Voting Shares”) and the relevant Shareholder will be entitled to receive one Special Voting Share for each such Ordinary Share.

Pursuant to the loyalty voting structure foreseeing a grandfathering system described in the Prospectus, any holder for at least four years in their own name of fully paid-up Sodexo Shares in registered form was entitled to request within 20 trading days following the payment date, i.e. on February 5, 2024 that holding of the Ordinary Shares be deemed to have commenced on the first day of the period for which such Sodexo Grandfathering Ordinary Share was uninterruptedly held by such holder in their own name.

If, at any time, such Ordinary Shares are de-registered from the Loyalty Share Register for whatever reason, the relevant Shareholder will lose their entitlement to hold a corresponding number of Special Voting Shares. Shareholders holding Special Voting Shares are entitled to exercise one vote for each Ordinary Share held and one vote for each Special Voting Share held.

Upon issue of Ordinary Shares or grant of rights to subscribe for Ordinary Shares, each Shareholder shall have a pre-emptive right in proportion to the aggregate nominal amount of their Ordinary Shares. Shareholders do not have pre-emptive rights in respect of the Ordinary Shares issued: (i) to employees of the Company or of a Group Company, (ii) against contribution other than in cash, and (iii) to a person exercising a previously acquired right to subscribe for Ordinary Shares. Pre-emptive rights may be restricted or excluded by a resolution of the General Meeting or another corporate body authorized by the General Meeting for this purpose for a specified period not exceeding five years.

There are no restrictions on the transferability of the Ordinary Shares in the Articles of Association or under Dutch law. However, the transfer of Ordinary Shares to persons located or resident in, or who are citizens of, or who have a registered address in jurisdictions other than the Netherlands, however, may be subject to specific regulations or restrictions according to their securities laws.

The Special Voting Shares are governed by the provisions included in the Articles of Association and the Loyalty Voting Plan. These documents govern the issuance, allocation, acquisition, sale, holding, repurchase and transfer of the Special Voting Shares and certain aspects of the transfer and the registration of the Ordinary Shares in the Loyalty Share Register. These documents provide in particular that:

- Shareholders holding Special Voting Shares are entitled to exercise one vote for each Ordinary Share held and one vote for each Special Voting Share held;

- no entitlement to Ordinary Shares’ dividend distributions is attached to Special Voting Shares. However, pursuant to the Articles of Association, holders of Special Voting Shares will be entitled to a minimum dividend, which is allocated to a separate Special Voting Shares dividend reserve (see below). The Company has no intention to propose any distribution from the Special Voting Shares dividend reserve; and

- a transfer of Special Voting Shares shall require the prior approval of the Board (see article 15 of the Articles of Association).

After the adoption of the Company’s financial statements that show that such distribution is allowed, the profits shown in the Annual Accounts in respect of a financial year shall be appropriated as follows, and in the following order of priority: (i) the Board shall determine which part of the profits shall be added the Company’s reserves, (ii) out of the remaining profits, an amount equal to one percent (1%) of the aggregate nominal value of the issued and outstanding Special Voting Shares, determined at the end of the last day of the previous financial year, shall be added to the Company’s special dividend reserve, provided that such amount shall be reduced, but never below zero, by any amounts added to the special dividend reserve in respect of any interim distribution from profits of the same financial year, and (iii) subject to article 27 of the Articles of Association, the remaining profits shall be at the disposal of the general meeting of shareholders for distribution on the Ordinary Shares. The Board shall determine how a shortfall that is determined by the adoption of the Company’s financial statements shall be accounted for. A loss may be set off against the reserves to be maintained by law only to the extent permitted by applicable law. All reserves maintained by the Company shall be attached exclusively to the Ordinary Shares, except for the special dividend reserve and the special capital reserve maintained for the holders of Special Voting Shares pursuant to the Articles of Association. The special voting capital reserve shall be applied exclusively for facilitating an issue of Special Voting Shares. For this purpose, the Board may allocate any part of the balance of the Company’s share premium reserve to the special capital reserve and vice versa.

If the Company is dissolved or liquidated, the Company’s assets shall be paid to secured creditors, preferential creditors (including tax and social securities authorities) and unsecured creditors, in that order. The balance of the assets of the Company remaining after all liabilities and the costs of liquidation have been paid shall be distributed to the Shareholders in the following order of priority and in accordance with the Articles of association: (i) the amount paid up on the Special Voting Shares shall be repaid on such Special Voting Shares and (ii) any remaining assets shall be distributed to the holders of Ordinary Shares.

-

2.5 Remuneration report

This section, which represents the Remuneration Report, has been prepared by the Nomination and Remuneration Committee, with due observance of the requirements of Dutch law and the Code. It provides an overview of the implementation of the applicable remuneration policy for the Board of Directors, including the Executive Chair, in Fiscal 2025.

At the Fiscal 2024 Annual General Meeting, Pluxee’s shareholders voted on Pluxee’s remuneration report for the first time since the Company’s listing, with an 85.7% level of support.

Following the Annual General Meeting, the Board reviewed the voting results and shareholder’s feedback. It initiated a constructive dialogue with investors and proxy advisors to identify areas for additional disclosure, in particular with respect to the Executive Chair’s remuneration. Although the remuneration framework was acknowledged as sound and aligned with Dutch law and the Code’s requirements, following this process and upon the recommendation of the Nomination and Remuneration Committee, the Board of Directors introduced enhancements to the Fiscal 2025 Remuneration report, including in particular:

- disclosure of the level of performance achieved against each criterion;

- more detailed explanations of the achievement of both financial and non-financial objectives;

- additional detail on the vesting scales; and

- prospective disclosure of the contemplated Fiscal 2026 annual variable remuneration criteria.

These improvements reflect Pluxee’s commitment to continuous progress in governance practices and to maintaining a constructive dialogue with shareholders. The Board will continue engaging with investors to ensure their perspectives are taken into account.

2.5.1 Main elements of Remuneration Policy for the Board of Directors

Pluxee’s current remuneration policy for the Board of Directors was adopted as disclosed in the Prospectus by the Company’s (pre-listing) shareholder on January 31, 2024 with immediate effect (the “Remuneration Policy”). No amendment to this existing remuneration policy, as applicable to the Board including the Executive Chair, will be submitted to the shareholders at the Annual General Meeting to be held on December 17, 2025.

The objective of the Remuneration Policy is to establish a competitive remuneration and benefits framework that enables the Company to attract, retain, and motivate Directors who possess the essential leadership qualities, skills, and experience to drive exceptional business performance and promote the sustainable success of the Company.

The Remuneration Policy promotes the achievement of Pluxee’s strategic short and long-term performance objectives contributing to the achievement of Pluxee’s sustainable long-term value creation. Accordingly, the Remuneration Policy and its implementation serve Pluxee’s long-term interests and promote its sustainable success.

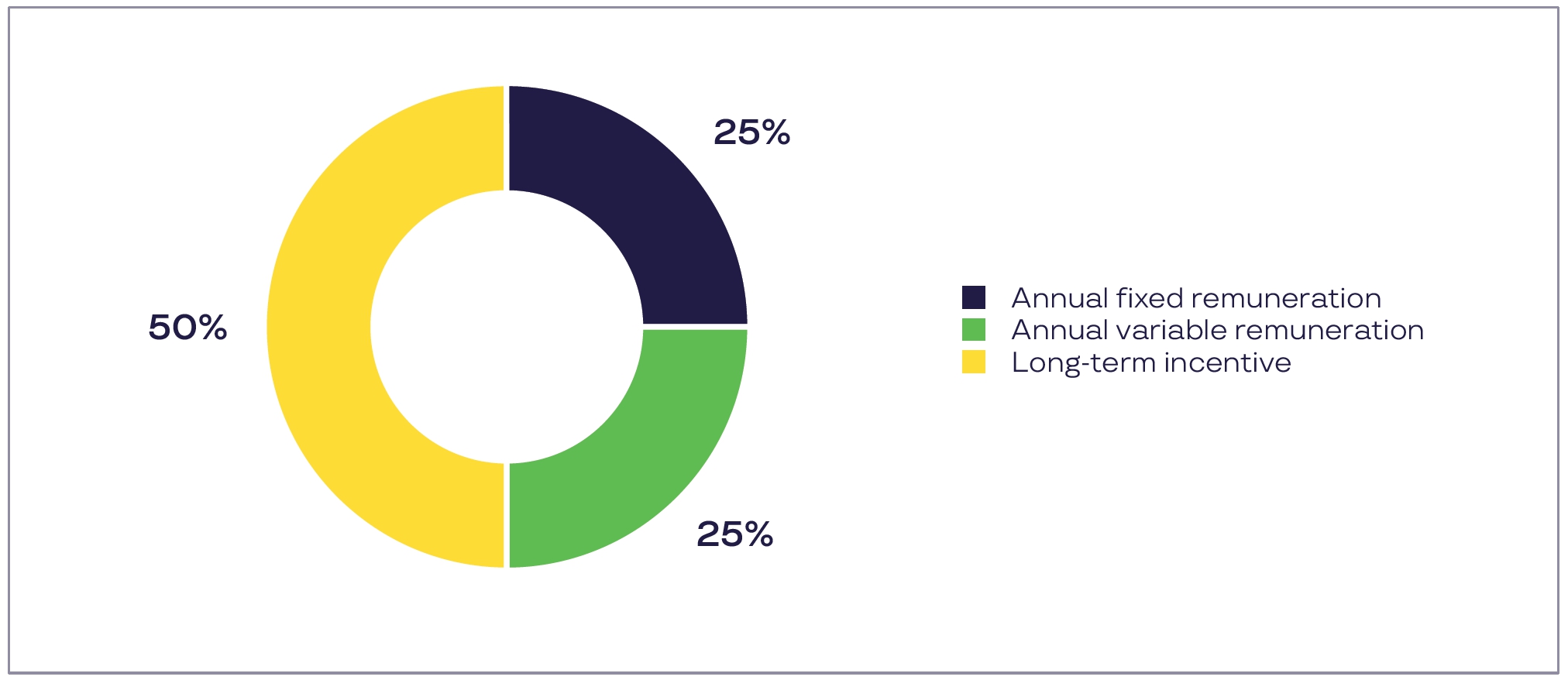

The Remuneration Policy establishes a fair, responsible, and transparent remuneration framework, consistent with Pluxee’s identity, mission, and corporate principles.